An interview with Maryville University’s Somer Anderson on the online Bachelor of Science in Accounting

With nearly 7,000 enrolled students across all 50 states and 55 countries, Maryville University in St. Louis has become a prominent destination for higher education. However, not all students need to be on campus to go to class. Maryville offers a number of online programs as part of its 90-plus degrees, and today, online learning is as valuable and desirable as on-campus courses.

According to a report by Babson Survey Research Group, Pearson, and Quahog Research Group, more than 5.8 million students were enrolled in at least one online course by the end of 2014. Almost 3 million students were only enrolled in online programs. Private institutions like Maryville University had more than 371,000 students enrolled in exclusively online undergraduate programs for the Fall 2014 semester, and more than 260,000 students in online graduate programs at that time.

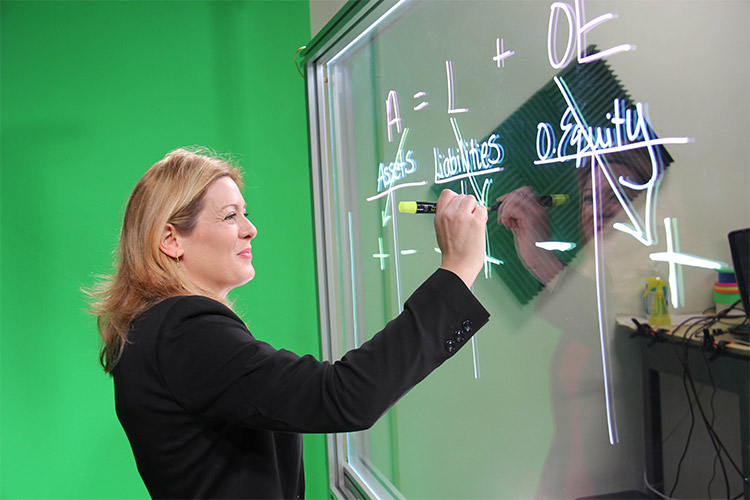

As interest in online degrees grows, so too do the questions from prospective students. To shed some light on distance learning at Maryville, let’s look at the 100% online Bachelor of Science in Accounting (BSACC) program and explore career outcomes, program features, and more. Few understand the online degree better than Somer Anderson, CPA, assistant dean and assistant professor of accounting at the John E. Simon School of Business at Maryville University. Recently, Anderson sat down to answer a few common questions about online higher education and the accounting degree.

Q: How long have you been in higher education, and which courses do you teach?

Somer Anderson: I’ve been in higher education for seven years. Before, I was an auditor at a public accounting firm and a finance manager at a large healthcare organization. At Maryville, I teach Financial Accounting, Auditing, Accounting Information Systems, and QuickBooks.

Q: What led you to want to switch into teaching full time?

A: While I was working as a finance manager, I began adjunct teaching in a weekend accounting program. I fell in love with teaching and pursued a full-time position when one came available.

Q: What are some of the core components of the online Bachelor of Science in Accounting program?

A: Our curriculum is designed around your career goals. Within the program, we have pathways that will take you to the CPA, to forensic accounting, or to more of an accounting services career.

Q: What makes this online program unique?

A: We are uniquely focused on your career goals and have designed our curriculum to provide support and guidance along your path to success.

Q: Why is now a good time to earn a BSACC degree?

A: The accounting industry is changing. Technology is huge, as cloud computing, mobile devices, social media, and more improve access to financial data. This could mean more clients and more informed clients, and professionals have to be knowledgeable in this new technology.

Q: Which courses are popular among students and faculty?

A: Our forensic accounting courses are very popular among both students and faculty. We believe in the importance of developing these skills in our students and require them to take a forensic accounting course as part of the foundational accounting core.

Q: Are there any additional certifications, courses, or exams commonly required in addition to the BSACC degree for the typical career path?

A: We strongly encourage our students to continue on to our Master of Science in Accounting degree so they will have the educational and credit hour requirements to take the CPA exam. We also encourage our students to become QuickBooks certified before graduation.

Q: What is faculty-student interaction like at Maryville?

A: The accounting faculty at Maryville is extremely interested in each student’s success. We interact with our online students several times a week via discussion boards and videos, and are always available for a phone or Skype chat if students have questions or just want to chat. We are well-connected and active in the accounting industry, which enables us to learn of internship and job opportunities that we can connect our students with. We are also active researchers able to integrate these trends into the accounting curriculum to keep it on the cutting edge and to share them with our students so they have a leg up during the job search.

Q: Can you describe the educational backgrounds of BSACC students? Are they already interested in accounting?

A: It depends on where they are in their studies upon program entry. Students starting as true freshmen have not typically had an accounting course and don’t realize they have the knack for it until they take ACCT 210 in the Business core. Students who are further along in their programs when they come to Maryville have often had at least ACCT 210 and ACCT 211, have realized they enjoy this type of work, and are ready to dive into the accounting core courses.

Q: What advice would you give to a new student in the online BSACC program to be successful?

A: I would say don’t just go through the motions as you are completing your online program. Take time to really engage with the material, ask questions, and take your professors up on their offers to video chat with you. As with most things in life, you get out of your education what you put into it. When your professors know that you are truly interested in the material/program and they understand your career goals, they will do everything they can to help you meet those goals.

Q: Do BSACC graduates typically pursue a master’s degree upon completion? If yes, why?

A: They do. The CPA exam requires 150 college credit hours (along with other requirements). Most students graduate with 128 college credit hours and obtain the remaining credit hours by completing the Master of Science in Accounting. Our MS Accounting program not only helps you obtain those hours, but it also sharpens your analytical skills to get you ready for the profession and has built-in CPA review courses to further prepare you for the exam.

Q: What are the most desirable career outcomes among BSACC students?

A: To be employed in your chosen field. That might be as a CPA at a CPA firm, as a forensic accountant with the FBI, or as a tax accountant.

Q: Which types of employers are popular among BSACC graduates?

A: Public accounting firms, banks, corporations, insurance firms, and the government. Many also start their own accounting services businesses.

Q: Does Maryville University offer any career assistance for students?

A: Yes. Through Maryville’s career services page. I also post all job opportunities, scholarships, events, etc. to the Accounting Program Canvas page.

Q: What feedback do you hear from students about the program?

A: Our students are thankful for their Maryville accounting education because they are employed in their chosen fields upon graduation and they also feel prepared for the CPA exam.

Recommended Reading

10 Best Cities for Accountants in 2017

What Can I Do With an Accounting Degree?

Sources

Online Learning Survey, Online Report Card – Tracking Online Education in the United

Online Learning Survey, Survey Info – Tracking Online Education in the United States/62