What Is Investment Banking? Definition, Careers, and Salary

Tables of Contents

Companies call on investment bankers to help them manage their finances. Whether a company is issuing stock, developing a game-changing technology, or looking to finance a facility’s expansion or other large capital investment, investment bankers offer the services and support to make it happen.

To answer the question, “What is investment banking?” consider that in a typical working day, an investment banker may perform any of these tasks, as The Balance Careers explains:

- Help companies raise funds through equity or debt offerings

- Create financial models that show the costs and benefits of a merger or an acquisition

- Use transaction comps, discounted cash flow, leveraged buyout techniques, or other methods to conduct a business valuation analysis

- Research specific companies or industries to find prospective clients and new businesses to assist

- Manage the various stages of a financial transaction, from initial pitch to contract signing

Investment bankers fulfill many vital roles for businesses, which ensures their continued success. However, the high salaries and prestige that come with investment banking positions heighten competition for available jobs. The right education, work experience, and professional certifications will improve the job prospects for people looking to enter this dynamic and important field.

Investment banking definition

An investment banking definition begins by identifying the field as a category of financial services that focuses primarily on selling securities and underwriting a company’s sale of new equity shares to raise capital. However, the roles that investment bankers play in helping businesses ensure a steady flow of capital go beyond underwriting.

Products and services offered by investment banks

The two methods used most often by investment bankers to raise capital for their clients are issuing debt and selling equity in the company, as Investopedia explains.

- Debt is typically issued by selling corporate bonds to investors. Investors usually receive a fixed return on their investment for a set number of years. The company pays investors interest throughout the term of the bond, and when the bond term ends, the firm remits the principal back to the investor. In addition to helping the company structure the bonds, the investment banker’s role is to find qualified investors by tapping the bank’s network of potential sources of capital.

- The most common way for companies to sell equity in the business is via an initial public offering (IPO). Preparing for an IPO entails potential investors doing extensive research into the firm’s operations and outlook for success. Investment bankers are charged with lining up large investors who are willing to take an equity share in the company at a price per share that meets the firm’s needs and the investors’ expectations for returns on their investment.

Equity underwriting

Investment bankers frequently arrange for their business clients to receive financing from capital markets. In doing so, they may underwrite the deals by buying the securities from the issuers, and then selling them to the public or institutional buyers as a way to manage risk.

Investopedia explains that investment bankers purchase the securities at one price, and then add a markup on the sale price to generate a profit that compensates for the risk inherent in the transaction. This is called the underwriting spread. To spread the risk further, the lead investment banker may work with a group of investment bankers called a syndicate to underwrite the issue.

However, investment bankers sometimes serve only as the go-betweens in promoting the marketing of the securities without assuming any underwriting risk. They may have the option to get paid for selling the securities on a commission basis depending on the amount of securities they sell.

Debt issuance (bond underwriting)

When a company wishes to raise capital by issuing a bond, it works with an investment banker for advice on matters such as how to determine the yield and maturity. In some cases, the investment banker will purchase the entire bond issue, which is referred to as firm commitment underwriting. In other cases, the bank may sell the bonds itself. This is often done by the bank forming a syndicate or selling group that offers the bonds for sale to institutional investors or the public.

- The primary bond market is where newly issued bonds are sold to the public; most of the proceeds are paid to the bond issuer.

- The secondary bond market is where bonds are resold by investors; the proceeds go to other investors rather than to the issuers.

- A bought deal is when an investment bank gives a company a firm commitment to buy a set number of bonds at a specified price for a set yield and maturity.

Pricing newly issued stocks and bonds

A new issue is a security that’s been registered and issued and is ready to be sold to the public for the first time. Both debt and equity can be newly issued, although the most common form of new issue is an IPO. New issues are also called primary shares or new offerings. They’re popular with investors whose demand pushes up the sale price.

Companies record new issues of stock as paid-in capital on their balance sheets, which is equal to par value plus additional paid-in capital (the amount the stock was sold for above par value). By contrast, bonds aren’t traded like stock, as Investopedia explains. Instead, they’re treated as loans made to the issuing company (or the government in the case of government-issued bonds).

- Each bond has a par value and can be traded at par, for a premium, or at a discount.

- While the interest paid on a bond is fixed, the yield, which is the interest payment relative to the bond price, changes along with the bond’s price changes.

- Bond prices fluctuate on the bond market based on supply and demand. The bond price is set by discounting the expected cash flow to the present by applying a discount rate.

- Term to maturity and credit quality also affect bond pricing.

Advising and facilitating mergers and acquisitions

Investment bankers advise companies that are planning to acquire other companies on the best way to structure the acquisition. They also explain the aspects to consider when pricing the offer.

- Investment bankers calculate the value of the target company and a sale price that represents its value.

- When a company puts itself up for sale, investment bankers are employed to determine an asking price and evaluate offers received.

Planning and management of initial public offerings

When a company decides to do an IPO, it works with investment bankers to create a prospectus that explains the offering’s terms and risks. Investment bankers also manage the issuance process with the U.S. Securities and Exchange Commission (SEC) and help the issuing company set a price for the offering.

Pricing the IPO shares is critical to the offering’s success. For one thing, setting the price too high could cause the public to lose interest in the investment. At the same time, pricing the IPO too low could reduce the amount of revenue the issuing company realizes from the offering.

Resources on investment banking

- The Balance offers a detailed description of investment banks, including how their work contributes to the health of the overall economy.

- InvestingAnswers illustrates both the buy side and sell side of investment banking, as well as how regulation affects the industry.

Investment banking salary

Investment banking salaries are among the highest in the financial services industry. The salaries of investment bankers are impacted by how many years they’ve been in the business and what skills they bring to the workplace.

Typical investment banking salaries

The U.S. Bureau of Labor Statistics (BLS) estimates that the median annual salary for securities, commodities, and financial services sales agents was $62,270 as of May 2019. However, the BLS notes that agents working with securities, commodity contracts, and other financial investments earned a median annual salary of $86,840.

In particular, investment bankers in corporate finance and mergers and acquisitions have the opportunity to earn a substantial bonus, according to the BLS. For higher-level investment banking job titles, the bonus can be more than the annual salary. The salary survey site PayScale estimates that the average annual salary for investment bankers is approximately $100,000 as of June 2020. PayScale lists typical compensation (salary and bonus) for investment bankers at various stages of their careers:

- Entry level: $76,000

- With one to four years of experience: $91,000

- With five to nine years of experience: $125,000

- With 10 to 19 years of experience: $146,000

Skills that affect investment banking salaries

An investment banker’s compensation depends largely on the skills the person brings to the position inside and outside the financial services industry. In addition to business knowledge, investment bankers must possess analytical skills, time and project management expertise, and solid interpersonal skills, as The Balance Careers points out.

Team leadership

Because investment bankers often work in ad hoc teams made up of co-workers, executives employed by their clients, and other third parties, they must have the ability to coordinate and manage the efforts of disparate teams. Leadership experience can be gained by:

- Participating in projects while earning their degree

- Earning professional certificates that include leadership components

- Doing volunteer work for nonprofit business assistance organizations

Merger and acquisition experience

Preparing for and completing a corporate merger or acquisition usually takes a great deal of time and effort. Investment bankers can gain experience with mergers and acquisitions by participating in a team that’s on either the sell side or the buy side of the transaction. The investment banker’s role differs depending on which side of the deal the investment banker represents. However, some skills are important in both instances. Investment bankers must:

- Be up to date on market and industry trends

- Understand the bidding process and bidding strategies

- Know how to perform financial analyses of capital structures and financial forecasting

Investment management

Investment managers help companies ensure that their finances are managed efficiently and in ways that contribute to the company’s goals. Experience gained by working as an investment manager can boost the career opportunities of investment bankers by giving them an insider’s view of corporate financial management processes.

The financial analysis and analytics tools used for managing corporate finances can also be used to assist in such investment banking tasks as pricing new stock and bond issues, calculating the value of an acquisition target, and determining the risk and financial potential of investment opportunities.

Banking experience

Mergers & Inquisitions describes the various pathways to a career as an investment banker, one of which is to earn “steppingstone” internships or jobs with banks, corporate finance departments, or small private equity/venture capital firms. Banks feature many positions that improve an investment banking candidate’s profile by teaching skills and providing hands-on experience working with corporate clients. They also share many of the analytics tools and financial management processes that investment bankers rely on in their work.

Resources for investment banking salary

- Mergers & Inquisitions reports on the results of a survey of investment banker salaries that includes a detailed description of how investment banking compensation works.

- Robert Half offers a salary guide for accounting and finance professionals that compares investment banker salaries to those of other financial positions.

How to get into investment banking

People wondering how to get into investment banking should know that the process begins by earning a bachelor’s degree in finance, economics, or a related field. The next steps are to gain practical work experience in the field and be certified as a Chartered Financial Analyst by the CFA Institute, among other investment banking certifications. A master’s degree in finance is also valuable.

Certifications and credentials

Before securing work as a broker or an investment banker, a person must register with the Financial Industry Regulatory Authority (FINRA). A person must also pass a series of exams to receive a license.

Other licenses are required to sell specific investment products and services, and renewing a FINRA license entails attending continuing education courses.

Other certifications can enhance a person’s chances of earning a position in investment banking.

- Chartered Financial Analyst (CFA) from the CFA Institute

- Chartered Investment Banking Professional (CIBP) from the Investment Banking Council of America

- Investment Banking Professional Credential (IBPC) from the IBP Institute

CFA Institute Chartered Financial Analyst

The CFA Institute describes the four steps required to become a charterholder:

- Pass all three levels of the CFA exams that test financial knowledge as well as ethical and professional standards.

- Complete the work experience requirements before, during, or after finishing the CFA program.

- Submit two or three letters of professional references that detail work experience and professional character.

- Apply to become a charterholder as a regular member with qualified work experience as an investment manager, or as an affiliate member if unable to meet the requirements to become a regular member.

Investment Banking Council of America Chartered Investment Banking Professional

The CIBP is divided into four tracks based on level of education and experience working in the finance and investment fields.

- Track 1 requires a Master of Business Administration (MBA) or other finance-related master’s degree and at least two years of experience working in investment banking, mergers and acquisitions, private equity, or related employment.

- Track 2 requires a bachelor’s degree in accounting or other financial major and at least three years of experience working in investment banking or a related field.

- Track 3 is for students currently in MBA or other finance-related master’s programs from institutions accredited by the IBCA or other global accreditation bodies.

- Track 4 is available to anyone currently working in a finance-related position who possesses a bachelor’s degree and an active CFA credential or other certification from a global accreditation body.

IBP Institute Investment Banking Professional Credential

Earning an IBPC requires passing a four-hour exam that covers topics related to investment banking:

- Accounting, financial statement analysis, and financial reporting

- Microsoft Excel and PowerPoint for investment bankers

- Financial statement modeling

- Corporate finance, markets, and valuation modeling

- Merger and acquisition process and merger analysis

- Leveraged finance and leveraged buyout (LBO) analysis

- Effective communication

After passing the exam, candidates must demonstrate at least one year of work experience in the financial services industry within four years of passing. They must also have at least a bachelor’s degree or equivalent education, and they must adhere to the IBP Institute’s code of ethics.

Education requirements for investment bankers

An investment banking education typically starts with an undergraduate degree in finance or economics. The BLS states that an MBA or other advanced degree in finance, economics, or mathematics is often required for high-level positions in investment banking and other securities industries.

One of the most important aspects of a finance education is the opportunity to develop a professional network, which is boosted by finding an internship with an investment banking firm while enrolled in a degree program.

Investopedia emphasizes the value to students of selling themselves. The site advises students to mix and mingle with potential employers or professionals whenever the opportunity arises. These people are in a position to give a boost to someone starting out in the field.

Private equity vs. investment banking

Both private equity and investment banking have reputations for high pay and long hours. However, the duties, skills, and requirements for the two careers differ in many important ways. The aspects to consider when comparing private equity vs. investment banking include the type of clients, the type of work, and the ultimate career goals.

Private equity’s focus: Manage high net worth funds and business investments

Private equity continues to grow in popularity, as business acquisition consulting firm Ace Chapman reports. Both private equity and investment banking are engaged in raising capital for investment purposes. Investment banking, however, focuses on consulting and capital raising services for corporations seeking investors, while private equity manages their clients’ actual investments.

Private equity serves as a source of investment capital for private firms. It’s used primarily by large institutional investors and to pool capital from high net worth individuals, insurance companies, endowments, and pension funds.

Private equity services often target investments in firms that aren’t publicly traded. They charge an agreed-upon percentage of the sum invested in exchange for the potential high returns on the investments made by clients.

Investment banking’s focus: Find investors and sources of capital for businesses

Investment banking’s primary role is to underwrite debt and securities for all types of corporations. Investment bankers enter into capital markets to identify investment sources and advise their corporate, government, and other institutional clients as they negotiate mergers and acquisitions and other complex transactions.

As underwriters, investment bankers offer a guarantee against financial loss and accept financial risks on behalf of their clients. In addition to identifying sources of capital for their clients, investment bankers manage and oversee the many stages and processes required to complete a merger or an acquisition.

Consulting vs. investment banking

Positions in financial and management consulting and investment banking are in great demand in large part because both fields offer rewarding career paths. A primary difference between consulting vs. investment banking is how closely consultants work with corporate clients to identify inefficiencies.

Investopedia points out that management and financial consultants rely on their problem-solving skills as well as their ability to communicate with corporate officers and managers about the changes required to improve their operations.

By contrast, investment bankers’ communication skills focus on explaining the implications of debt and equity raising strategies, rather than on persuading managers and executives to take specific actions.

Career opportunities for investment bankers

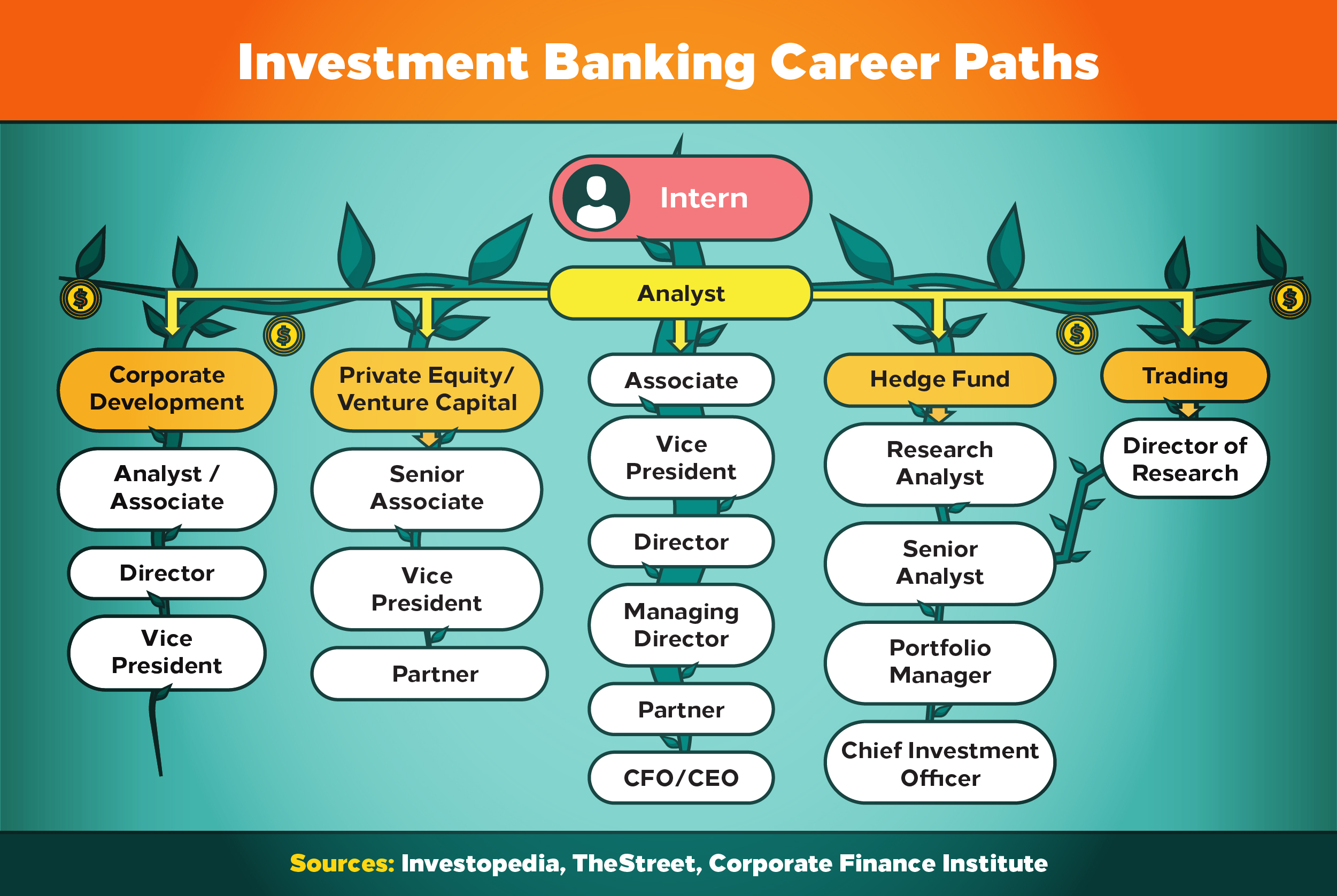

Mergers & Inquisitions presents a typical career path for investment bankers:

- Intern

- Analyst

- Associate

- Vice president

- Director or senior vice president

- Managing director

Senior to the managing director position are senior managing director, group head, chief operating officer, CEO, and other officer-level titles.

Career opportunities for financial and management consultants

The two types of consultants offering specialized financial and management advice to organizations are:

- Contractors who work independently

- Consulting firm employees

Consulting firm employees tend to be older and rely more heavily on their professional networks, according to Investopedia.

Consultants typically are certified as one of the following:

- Chartered Financial Consultant (granted by the American College of Financial Services)

- Certified Management Consultant (issued by the Institute of Management Consultants)

Financial consultants help businesses improve shareholder value and capital efficiency. Management consultants assist organizations as they plan and implement changes designed to make their operations more efficient and profitable.

The BLS forecasts that the number of jobs for management analysts will increase by 14% between 2018 and 2028, which is much faster than the average for all occupations. By contrast, the number of jobs for financial analysts is projected to increase by 6% between 2018 and 2028, according to the BLS, which is about the average for all occupations.

Skills investment bankers need

The top skill required to succeed as an investment banker is intellectual ability, according to Investopedia. This allows investment bankers to analyze an industry, market, or business quickly and assess its current value and potential for growth. Other valuable skills for investment bankers are:

- Analytical skills to conduct complex analyses that are accurate, complete, and clearly communicated to business decision-makers

- Diplomacy in negotiating multimillion-dollar business transactions

- Management and leadership skills to guide teams and nurture the careers of subordinates

- Entrepreneurial skills to understand the nuances of mergers and acquisitions, corporate restructuring, and other complex business transactions

Skills management consultants need

Management consultants need a broad range of skills in their work.

- They must understand management structures.

- They must be able to spot areas that aren’t operating efficiently and know the mechanisms and processes that will improve the company’s operations.

- They must have problem-solving abilities, be self-motivated, and possess high-level organizational skills.

In addition to being adept at communicating with business managers face to face, management consultants must produce written reports, manuals, and other forms of documentation. They must be critical thinkers who also possess a creative streak and are adept at time management, according to The Balance Careers.

Other investment banking careers

Many finance and economics students are drawn to a career as an investment banker by the prospect of earning high salaries and bonuses in their first years in the profession. However, Investopedia points out that an investment banking career often leads to prestigious positions in portfolio management, venture capital, private equity, and wealth management.

Experienced gained as an investment banker often leads to careers in related fields of finance.

- Overseeing the portfolios of clients

- Consulting with businesses on financial and management projects

- Becoming a financial manager for a company

- Joining with others to start businesses as an entrepreneur

Pathway to portfolio management

Portfolio managers are charged with overseeing the assets of their clients, including stocks, bonds, and other forms of investments. This contrasts with the work of investment bankers, who serve the capital raising needs of their corporate clients by arranging and otherwise assisting the purchase and sale of securities.

While the two roles appear to be distinct, their duties overlap when it comes to required skills and experience with financial instruments and markets. WallStreetMojo explains that portfolio managers deal with assets that their clients already own, while investment bankers connect companies in need of assets with investors looking for opportunities to enrich their holdings.

Portfolio managers typically handle large funds for their well-heeled clients, so they deal directly with a handful of clients on a regular basis. By contrast, fund managers oversee smaller funds for a larger group of clients, and investment bankers work with many different companies and investors on deals to raise capital. However, both portfolio management and investment banking require in-depth analyses of financial markets.

Become a financial and management consultant

Most finance positions, including those in investment banking, require a depth of knowledge about financial instruments and markets to ensure that their corporate clients receive maximum return on their capital investments.

As WallStreetMojo points out, financial and management consulting involves general knowledge of a range of fields that encompass management and economic theory, strategy, and technology.

Become a financial manager

Financial managers include controllers, treasurers, finance officers, credit and cash managers, risk managers, and insurance managers, as the BLS explains. They work for a single company rather than having several corporate clients as is typical in investment banking. However, their work entails performing financial analysis and forecasts, reviewing financial reports, analyzing market trends, and assisting in financial decisions, all of which are skills required for investment banking.

Become an entrepreneur

Investment banking is perceived as one of the most secure positions in the financial services industry. However, many investment bankers decide at some point in their careers to transition to entrepreneurship by founding a company, which is one of the riskiest endeavors in the industry. Investing for Beginners writes that the change isn’t as far-fetched as it might appear because many investment bankers see entrepreneurship as the best way to maximize their earnings potential.

After all, an investment banker works long hours negotiating financial deals that are typically valued in the millions of dollars. Many see starting their own companies as a way to break free from working for others and to broaden their duties beyond advising companies on issuing debt and equity and assisting with mergers and acquisitions.

Resources for other investment banking careers

- Investopedia compares and contrasts the career options and outlook for investment bankers and management consultants.

- Mergers & Inquisitions provides a complete guide to investment banking career paths that covers typical duties, career requirements, and several related job descriptions.

Providing businesses with resources to thrive

Without business and industry growth, economies stagnate. Without ready sources of capital, businesses would struggle to pay for their growth and expansion plans that fuel economies. Investment bankers play a critical role in connecting businesses in need of capital with investors looking for opportunities.

The strong competition for investment banking positions indicates the financial and professional rewards available to people who pursue a career in investment banking. The right combination of education, certification, work experience, and skills improves a candidate’s chances of landing a challenging and rewarding job as an investment banker.

Additional Sources

1000 Years of Career Advice, “Investment Banking Career Pros and Cons: A Comprehensive Guide”

Corporate Finance Institute, Corporate Development Career PathDealRoom, “Private Equity Investment vs. Investment Banking”

Financial Times, “How Do I Go About Getting into the Investment Banking Industry?”

Financial Times, “How the Biggest Private Equity Firms Became the New Banks”

Investopedia, “Financial Analyst vs. Financial Consultant Careers”

Investopedia, “How to Become an Investment Banker”

Investopedia, “What Do Investment Bankers Really Do?”

Medium, “The Intersection of Venture Capital, Investment Banking, and Consulting”

Rate Rush, “What Is Investment Banking?

Robinhood, “What Is Investment Banking?

SmartAsset, “Investment Banking Defined”

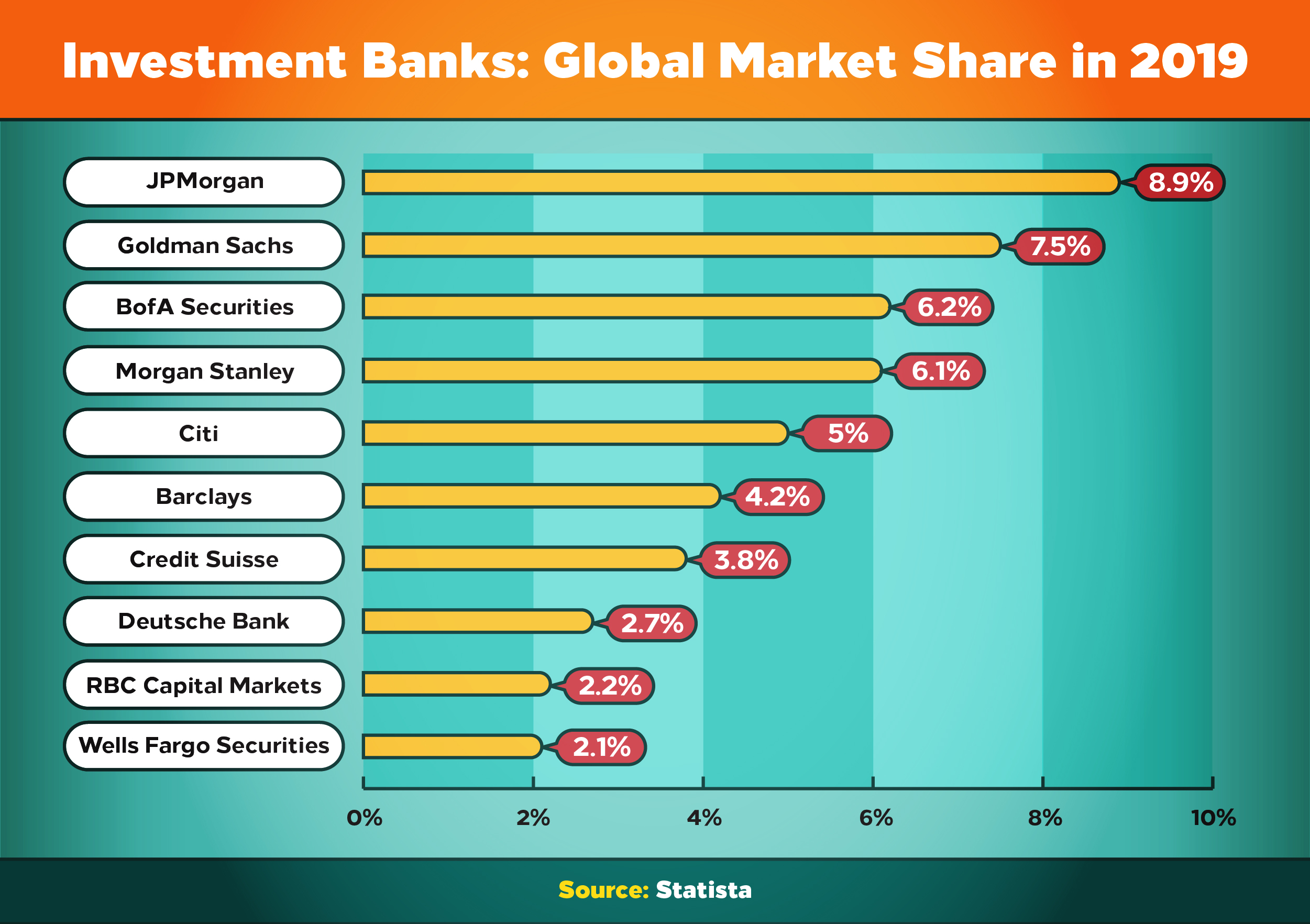

Statista, “Global Market Share of Revenue of Leading Investment Banks as of December 2019”

The Motley Fool, “What Is Investment Banking?”

The Street, “How To Become an Investment Banker”

TheStreet, “What Is Investment Banking and What Should You Know?”

Vanity Fair, “‘It’s, Like, Lawless’: How Private-Equity Headhunters Are Bleeding Wall Street”

Zacks, “Private Equity vs. Venture Capital vs. Investment Banking”