The Growth of Forensic Accounting

Forensic accounting isn’t your average accounting job — it’s a dynamic career path that connects the rules of economics with the laws of government to protect the financial well-being of businesses.

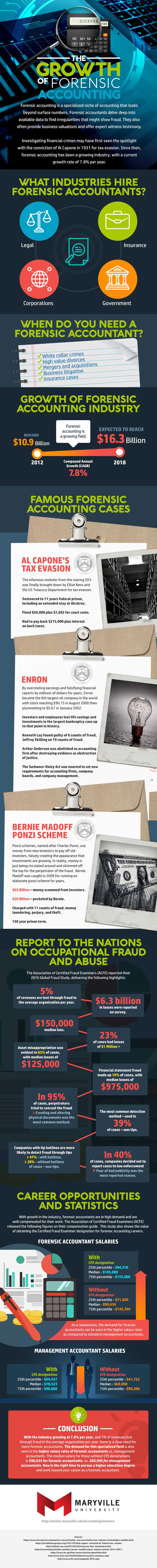

In this particular division of accounting, trained professionals provide an incredibly valuable service to organizations by investigating a variety of financial crimes, from tax evasion to business litigation.

As the business sector continues to grow, the need for skilled forensic accountants becomes more and more apparent. Data from the U.S. Bureau of Labor Statistics suggests that employment for accountants and auditors is expected to grow by 10% between 2016 and 2026, which is faster than the forecast average for jobs in other fields. Job growth within specialized niches, such as forensic accounting, are likely to remain robust.

When you earn your master’s degree in forensic accounting and build your field experience, you can learn the specialized skills needed to determine if companies or individuals are victims of financial crimes — or if they’re committing them.

To learn more about forensic accounting and historical cases involving forensic accounting work, view the infographic below:

Who needs forensic accountants?

Qualified forensic accountants are in high demand, and the career options available to them are diverse. With your Master of Science in Accounting, you can pursue opportunities with legal, insurance, corporate, government, and other business industries.

These organizations are continually hiring forensic accounting experts for a host of reasons, including investigation of white-collar crimes, high-value divorces, mergers and acquisitions, business litigation, and insurance cases.

As a forensic accounting specialist, you can help businesses save a significant amount of money by addressing or eliminating issues that plague the workplace. Some of the more prevalent issues include:

On average, an estimated 5% of revenues are lost through fraud per year.

Financial statement fraud made up close to 10% of cases in 2016, with median losses of nearly $1 million.

In 95% of cases, perpetrators tried to conceal the fraud.

Skills that help forensic accountants thrive

Data from the Association of Certified Fraud Examiners (ACFE) suggests that obtaining proficiency in the following areas could help you find success or better employment as an aspiring forensic accountant:

Ability to work independently

Acumen in accounting procedures

Analytical skills

Computer applications

Credibility

Focus on details

Integrity

Oral communication

Professional judgment

Professional skepticism

Regression analytics

Research skills

Summarization skills

Understanding of the legal system and legal procedures

Work environment

The BLS indicates that in 2016, accountants and auditors held approximately 1.4 million jobs throughout the U.S.

The bulk of professionals working in this field held jobs with accounting, bookkeeping, payroll services, and tax preparation companies, but others worked in government or financial and insurance service organizations; some reported working in managerial roles. Approximately 7% of professionals reported being self-employed.

The BLS also indicates that many professionals work in an office environment, alone or in a team-based setting. In some instances, accountants may need to travel to their client’s place of business.

Most accountants and auditors also indicated they worked in a full-time capacity, although for the year 2016, 20% of those employed reported working more than 40 hours per week.

How does forensic accounting relate to cyber security?

In the past several years, a number of high-profile companies have relied on forensic accountants after instances of cyber fraud. This was done for several reasons, including to help them quantify the resulting economic damage and — in some cases — to detail how the fraud occurred.

In addition, companies have relied on forensic accountants in the aftermath of cyber fraud to help them determine which type of evidence a company may be able to use as evidence, should the case be referred for criminal prosecution.

To accomplish this task, forensic accountants work closely with company management, their legal counsel, and in some cases, the company’s insurance company.

What are some career opportunities in forensic accounting?

Earning a master’s degree in accounting is a positive step and can open doors to a number of opportunities — but additional certifications may be required for higher-level positions in forensic accounting. These additional certifications, such as the Certified Fraud Examiner (CFE) certification, can help distinguish you among professionals as a leading expert in the field. It can also result in higher salaries and advanced career growth.

On average, standard management accountants earn less than forensic accountants. Statistics gathered from the Association of Certified Fraud Examiners show that without a CFE designation, the median salaries for standard management accountants range from $50,600 to $77,000, depending on their level of experience and primary industry of focus. Management accountants with a CFE earn a median salary in the range of $61,755 to $100,000.

There’s a wide range of salaries for forensic accountants. According to those same statistics, forensic accountants without a CFE earned a median salary between $53,040 and $200,000, depending on experience, industry, and level of responsibility. For forensic accountants with a CFE, salaries were higher, ranging from $60,000 to $270,000.

Improve your forensic accounting prospects with your master’s degree.

Career opportunities in forensic accounting are projected to continue to grow, and when you earn your online master’s degree in accounting from Maryville University, you could find yourself with a significant advantage. Learn more about our degree program, and see how graduate education could help you become well-positioned for an exciting, long-term career.

Sources:

Association of Certified Fraud Examiners, “Compensation Guide for Anti-Fraud Professionals”

Association of Certified Fraud Examiners, “Forensic Accountant”

Bureau of Labor Statistics, “Job Outlook, Accountants and Auditors”

Bureau of Labor Statistics, “Work Environment, Accountants and Auditors”

Hagen, Streiff, Newton & Oshiro, “How Forensic Accountants Help In Cyber Breach Cases”

Maryville University, Master of Science in Accounting Online