History of Accounting: How It’s Evolved Over Time

Tables of Contents

Accounting has come a long way from its infancy, both in its practices and in the ways that it’s helped shape society.

Accounting’s earliest days may have come 12,000 years ago, when people likely traded resources while primarily surviving by hunting animals and gathering fruit. By comparison, accounting today involves various electronic processes and is responsible for billions of dollars in sales. The Business Research Company reports that the market size of the global accounting services industry was nearly $588 billion in 2021 and projects that it will increase to $1.7 trillion by 2031.

The changes to accounting since its first days have occurred alongside some of the biggest shifts in society, with the industry influencing responses to technological shifts, financial crises, and ethics questions. Understanding the history of accounting is key to understanding many facets of society’s shifts over time.

Gain a solid foundation in accounting principles, financial reporting, auditing and taxation

The online BS in accounting from Maryville University will equip you with the skills to excel in the world of finance. Graduate in as few as 2.5 years. No residencies or standardized test scores (SAT/ACT) required.

- Prepare for your certified public accountant exam.

- Develop critical-thinking capabilities, strong computer and analytical skills, and the ability to translate accounting into everyday language.

History of Accounting

Accounting is the process of tracking financial information, providing a system for recording, verifying, analyzing, and reporting on transactions. In business, the term “accounting” refers to the tracking of income and expenses.

While the practice may have begun centuries earlier, accounting’s first official records are tax information on clay tablets from around 3300 B.C. Archaeologists discovered these artifacts in Egypt and the area that once was Mesopotamia. Around this time, historians believe, Egyptians were also using accounting to monitor their pharaoh’s possessions and uncover fraud.

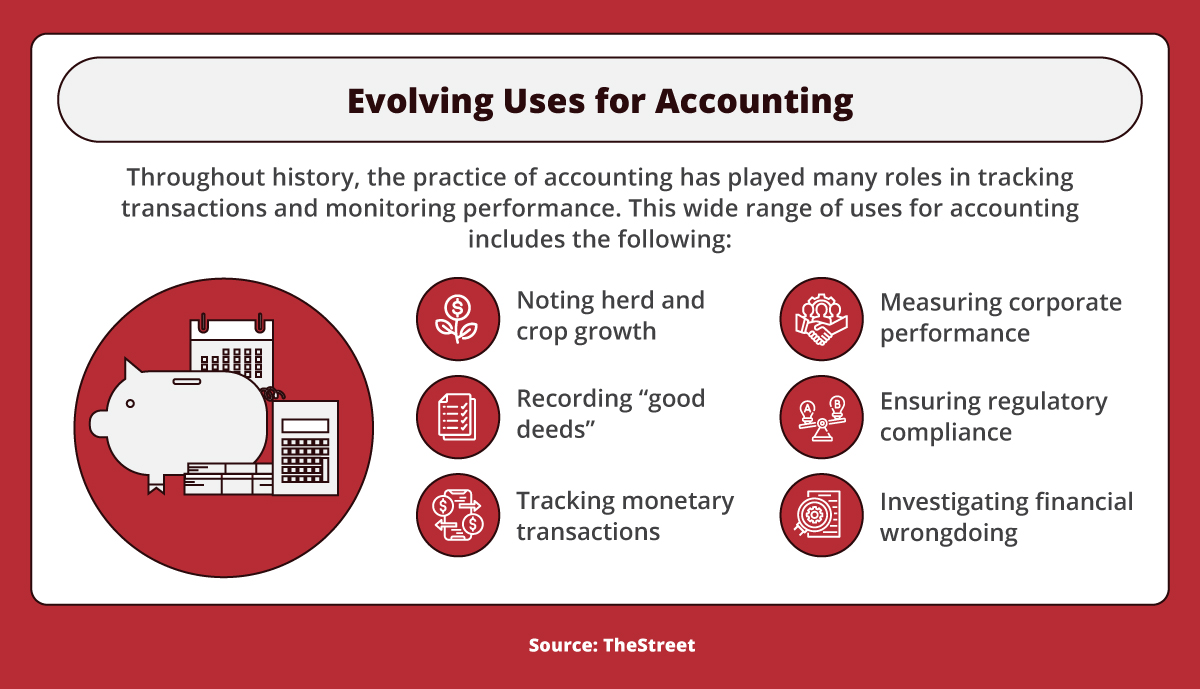

Throughout history, the practice of accounting has played many roles in tracking transactions and monitoring performance. This wide range of uses for accounting includes, according to TheStreet: noting herd and crop growth, recording “good deeds,” tracking monetary transactions, measuring corporate performance, ensuring regulatory compliance, and investigating financial wrongdoing.

Four Stages of Accounting History

The history of accounting incorporates four stages with distinct developments and processes. The first stage began in primitive times and ended in the 15th century, and the most recent stage began in 1951 and has lasted to the present. The stages follow:

Emergent

The first stage of accounting dates to the primitive days of civilization. Although historians haven’t uncovered a record of accounting practices during this time, they point to the first exchange of goods or services as the likely start of some form of record keeping. This period lasted until 1494, with the publication of the first book to describe double-entry accounting, a system using debit and credit entries.

Accounting practices that took place during the overall historic periods within this time frame include the following:

- Stone age — Marking ticks on cave walls and mountains, and in the jungle to record goods collected and loaned

- Primitive — Noting symbols on walls and making rope knots to designate transactions

- Barter — Recording deals made through barter for agricultural or other property

- Currency — Tracking monetary transactions, originally in Europe, related to transactions that bank loans financed

Preanalytic

The period between 1495 and 1799 in the history of accounting is called the preanalytic period. This span of time saw the introduction of some key accounting concepts:

- Going concern — A business’s ability to stay afloat

- Periodic inventory — The practice of recording financial entries at the end of each given accounting period

- Money measurement — A system that records only transactions that have monetary value

Development

The development, or explanatory, period in accounting dates from 1800 to 1950. This time frame includes two key shifts in business, with the industrial revolution moving much of the world to a manufacturing-based economy and the emergence of joint-stock companies bringing multiple business shareholders to the table.

The impact of these changes and others in the development period includes the following:

- Industrial revolution — Required tracking the large amounts of capital involved in establishing new corporations and railroads

- Joint-stock companies — Added complexity to doing business, with the financial concerns of shareholders and other business partners becoming factors

- Government regulation — Led to the development of uniform accounting practices to accommodate tax laws

Modern

From 1951 to the present day, accounting has been in its modern period, with accounting methods continuing their shift to meet uniform standards. The growing demand for long-term financial forecasting led to calls for accounting methods that accurately report current finances and project future conditions.

To accommodate the need for true and fair reporting, the U.S. accounting industry adopted generally accepted accounting principles (GAAP). These rules, standards, and procedures dictate the way that the nation’s public companies compile and report financial statements.

Some key issues in the global economy drove accounting developments in this period as well, including the following:

- Stock market crash of 1929 — Led to the enforcement of accounting standards and the establishment of the U.S. Securities and Exchange Commission (SEC)

- Ethics investigations — Helped to shape the profession’s standards and oversight, following high-profile instances of illegal accounting practices ranging from gangster Al Capone to energy company Enron

Recognition of Accounting as a Profession

The recognition of accounting as a profession occurred with the first organizations focused on the career. Established in Scotland in 1854, the Institute of Accountants and Actuaries in Glasgow and the Edinburgh Society of Accountants were the first professional organizations for accountants. The groups’ members called themselves “chartered accountants,” and the Glasgow organization petitioned Queen Victoria for a royal charter recognizing the role as independent from solicitors, a legal profession.

The American Association of Public Accountants (AAPA) followed in 1887. In 1896, the first accountants took the standardized test that designated them as certified public accountants (CPAs). In 1957, the organization that awards the CPA designation became the American Institute of Certified Public Accountants (AICPA).

History of Financial Accounting

Financial accounting is a branch of accounting involving the recording, summarizing, and reporting of the many transactions related to business operations over a period of time. These materials typically assist accountants with compiling financial information for outside parties. To record these transactions, accounting professionals use financial statements, including the following:

- Balance sheet — Reports assets, liabilities, and shareholder equity

- Income statement — Notes revenue, expenses, gains, and losses

- Cash flow statement — Summarizes the movement of cash into and out of a company

History of Financial Accounting Practices

Tokens and bookkeeping are evident from the history of financial accounting’s earliest recorded days thousands of years ago — but it was in 1458 when Benedetto Cotrugli invented the double-entry accounting system that established the foundation for modern accounting. He was a merchant, an economist, a scientist, and a diplomat from what was then the Republic of Ragusa.

However, Luca Bartolomeo de Pacioli, who was an Italian mathematician and a Franciscan monk, became known as the father of accounting. His 1494 book, The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality, includes a 27-page section about bookkeeping. It describes the double-entry system that Venetian merchants used.

The book was also the first to use plus and minus signs.

The accounting system that de Pacioli outlined called for tracking assets, liability, capital, income, and expense accounts — similar to the entries that appear on modern balance sheets and income statements. He warned that individuals shouldn’t go to sleep at night until their debits matched their credits.

Evolution of Financial Accounting Technology

Tools and technology have further revolutionized financial accounting, with professionals in various industries inventing processes to speed bookkeeping. Advancements that changed financial accounting include the following:

Adding Machine

One of the earliest advances in financial accounting tools was in the 1880s, when American inventor William Burroughs invented the adding machine. This tool allowed accountants to calculate more accurately and efficiently than previous methods, such as tokens, clay balls, and abaci.

Spreadsheet Software

Introduced in 1978, VisiCalc was the first spreadsheet software to allow financial modeling on the computer. That same year saw Peachtree Software launch an accounting software package for the personal computer. These developments, along with the 1998 introduction of QuickBooks for day-to-day bookkeeping, made financial accounting tasks easier to perform than relying on mainframe computers.

History of Forensic Accounting

Forensic accounting combines skills in accounting, auditing, and investigation to examine individuals’ or businesses’ finances. Forensic accounting often plays a role in legal proceedings in fraud and embezzlement cases, with uses in situations such as:

- Criminal investigations — Determining whether a crime occurred and identifying intent in cases such as employee theft or securities fraud

- Litigation support — Providing insight into the amount of damages to award in legal disputes

- Insurance claims — Using historical data to calculate economic damages from claims such as those for accidents or medical malpractice

Origins of Forensic Accounting

The earliest days of the history of accounting likely included forms of forensic accounting. Historians believe Egyptians monitored for fraud by tracking their kingdom’s possessions.

By the 1800s, accountants were serving as witnesses in court cases. In 1824, a Glasgow advertising circular was the first to refer to forensic accounting.

Some credit the understanding of fraud to a 1934 study by the authors of the book Principles of Criminology. However, Frank Wilson, an accountant for the IRS, may have played the biggest role in the history of forensic accounting. He established the modern version of forensic accounting when he helped convict Al Capone of tax evasion in the 1930s.

Today’s Financial Accounting

By the mid-1990s, forensic accounting had become its own distinct form of accounting. Regulations had placed much of the responsibility for anti-fraud protections in the hands of CPAs, with scandals in the financial world driving many of these new requirements.

For example, the savings and loan (S&L) crisis, which led to the failure of hundreds of savings and loan associations between 1986 and 1995, led Congress to pass the Financial Institutions Reform, Recovery, and Enforcement Act of 1989. The legislation revamped industry regulations to help curb the fraud that contributed to the crisis. Since that time in financial accounting history, forensic accounting has helped uncover financial inconsistencies that have led to scandals such as the following:

Enron Collapse

Enron became one of the fastest-growing U.S. companies in the 1990s — thanks in large part to hidden debt and bad assets. The company collapsed following a thorough review of financial statements that uncovered fraud.

The Sarbanes-Oxley Act of 2022, which reformed corporate financial practices, was a response to the Enron scandal.

Lehman Brothers Bankruptcy

Once the fourth-largest investment bank in the United States, Lehman Brothers grew through heavy reliance on high-risk real estate investments and subprime mortgages. Fiscal accounting following the bank’s downfall in 2008 revealed the depth of the problem.

The Lehman Brothers scandal led to the financial crisis of 2008. In response, the Dodd-Frank Wall Street Reform and Consumer Protection Act became law in 2010, with the aim of protecting consumers and taxpayers against risky bank investments.

Bernie Madoff Ponzi Scheme

Forensic accounting evidence first presented to the SEC in 2000 led to the 2009 arrest and conviction of American financier Bernie Madoff. His low-risk, high-return investment scheme defrauded thousands of investors out of billions of dollars over more than 15 years.

Modern Accounting Methods

Traditional, or British, accounting is a high-level approach to recording transactions that was predominantly used early in accounting’s history. The modern, or American, method of accounting is a more in-depth look at financial numbers that helps business leaders:

- Access data

- Analyze trends

- Develop forecasts

- Strategize to gain an advantage over competitors

Most developed countries now use modern accounting methods, which also typically rely on electronic processes for greater speed and accuracy.

Traditional Accounting vs. Modern Accounting

Different categories and tools define the two primary approaches to accounting. Below are some distinctions between traditional and modern accounting.

Traditional Accounting

Traditional accounting uses three categories for tracking transactions. Personal accounts relate to a person or organization, while real and nominal accounts are considered impersonal accounts that aren’t for a specific individual or firm.

- Personal — Transactions related to a person, firm, company, or other organization

- Real — Accounts whose balances carry from one accounting period to the next

- Nominal — Accounts whose balances close at the end of each accounting period, starting the next period with a zero balance

Modern Accounting

Modern accounting divides financial data into additional categories, including the following:

- Assets — Items of value that a company owns

- Liabilities — Debts payable to outside entities

- Capital — The value of assets minus liabilities

- Revenue — Cash coming into the company because of its primary business activities

- Expenses — Amount spent on items or activities to generate revenue

- Withdrawals — Funds withdrawn by the business owner for personal use

Technology and Modern Accounting

Various technological tools assist in tracking the various types of transactions that modern accounting captures. With these tools providing an efficient way of generating figures, today’s accountants have more time to focus on analyzing trends and providing guidance that informs corporate strategies.

Modern accounting methods increasingly use the following tools and processes:

- Digital payments and systems — Electronically calculating and sharing financial information and analysis

- Cloud storage — Maintaining accounting data off-site for access by multiple individuals in an organization

- Artificial intelligence and machine learning — Quickly and accurately analyzing large volumes of data

- Blockchain — Assists in maintaining a ledger and safely transferring asset ownership

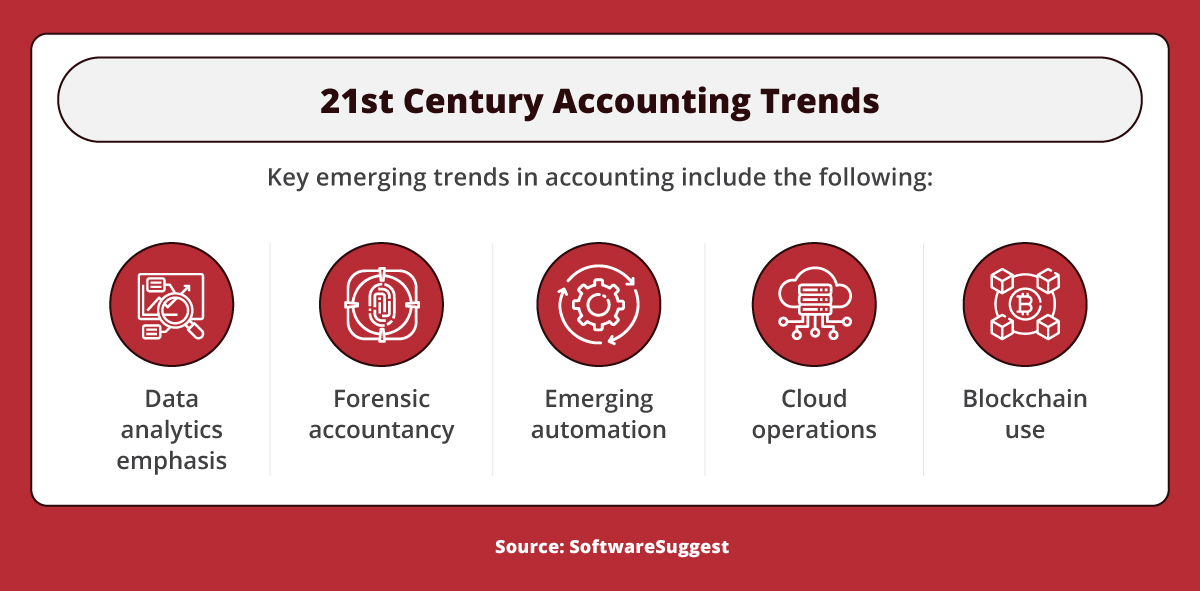

Key emerging trends in accounting, according to Software Suggest, include: data analytics emphasis, forensic accountancy, emerging automation, cloud-based operations, and blockchain use.

History of Accounting Timeline

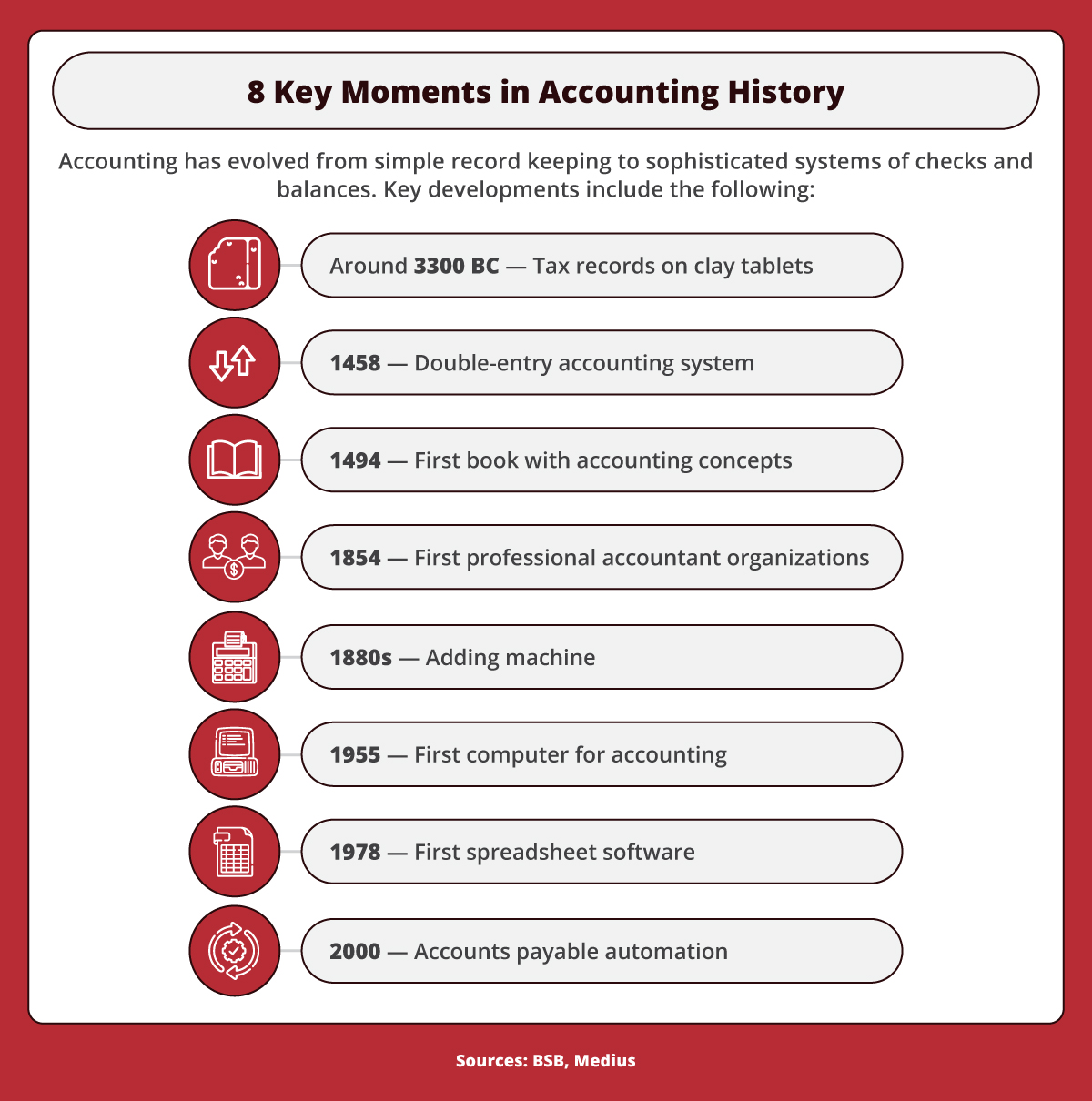

The history of accounting spans thousands of years, transforming from a simple recording of transactions to today’s complex system for recording, predicting, and investigating financial outcomes. The following history of accounting timeline includes highlights from the documented use of accounting:

- Circa 3300 B.C.: Earliest documented use of accounting. Artifacts show tax records on clay tablets.

- 1458: Invention of double-entry accounting method. Benedetto Cotrugli invented the double-entry accounting system, establishing the foundation for modern accounting.

- 1494: Publication of the first book describing the double-entry accounting method. Luca Bartolomeo de Pacioli, known as the father of accounting, published Summa de Arithmetica, Geometria, Proportioni et Proportionalita.

- 1854: Establishment of the first accounting professional organizations. The members of the Institute of Accountants and Actuaries in Glasgow and the Edinburgh Society of Accountants called themselves chartered accountants.

- 1880s: Invention of the adding machine. William Burroughs invented the adding machine, improving accounting’s speed and accuracy.

- 1930s: First high-profile use of forensic accounting. IRS accountant Frank Wilson uncovered financial irregularities that led to the arrest of Al Capone.

- 1955: First purchase of a computer for accounting use. General Electric made the first purchase of a computer to perform accounting functions such as payroll processing.

- 1978: Introduction of spreadsheet software. VisiCalc was the first spreadsheet software to allow financial modeling on the computer.

Accounting has evolved from simple record keeping to sophisticated systems of checks and balances. Key developments, according to BSC and Medius, include: Around 3300 B.C. — Tax records on clay tablets. 1458 — Double-entry accounting system. 1494 — First book with accounting concepts. 1854 — First professional accountant organizations. 1880s — Adding machine. 1955 — First computer for accounting. 1978 — First spreadsheet software. 2000 — Accounts payable automation.

Links to Learn More About Accounting

Accounting organizations offer resources that provide additional details about accounting and its background as well as jobs and certifications:

- Association of Chartered Certified Accountants — ACCA offers insights about the history and future of accounting for students, educators, and accountants.

- Association of Certified Fraud Examiners — The ACFE provides training, career resources, and the opportunity to pursue the Certified Fraud Examiner (CFE) designation.

- Association of International Certified Professional Accountants — AICPA offers exams for CPA and Chartered Global Management Accountant (CGMA) designations as well as resources on topics such as ethics, forensic services, and technology.

- American Accounting Association — The AAA caters to accounting professionals in the academic community by providing research, a newsletter, and a career center.

- Association of Nonprofit Accountants & Finance Professionals — ANAFP provides resources for accounting and finance professionals in the nonprofit sector, with materials about topics such as accounting and bookkeeping and tax returns.

- National Society of Accountants — NSA assists tax and accounting professionals with training, webinars, discount programs, and advocacy efforts.

Accounting: From Clay Tablets to Computers

From its earliest origins, accounting and the professionals who practice it have helped shape — and have been shaped by — some of the most influential events in global history. Those historical shifts continue today, with technology driving many of the latest developments in accounting, just as digital tools grow in importance throughout society. From maintaining balance sheets to investigating business records to analyzing financial data, accountants play a crucial role in business operations.

Infographic Sources

BSB, “Brief History of Accounting”

Medius, “The History of Accounting — from Record-Keeping to Artificial Intelligence”

Software Suggest, “13 Trends in Accounting for 2022 and Beyond”