What Is Financial Therapy? Financial Therapist OverviewWhat Is Financial Therapy? Financial Therapist OverviewWhat Is Financial Therapy? Financial Therapist Overview

Tables of Contents

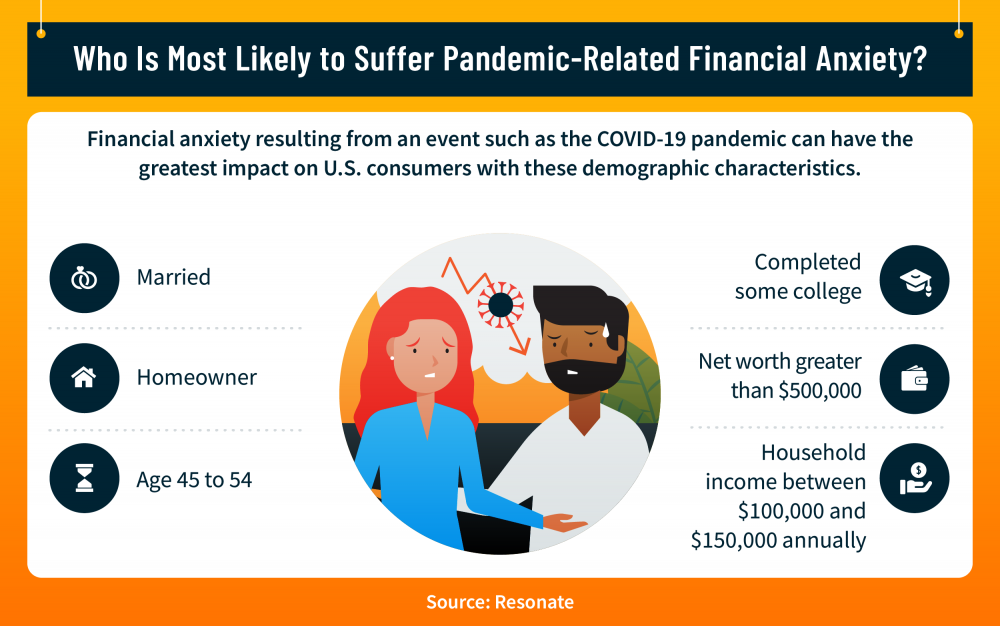

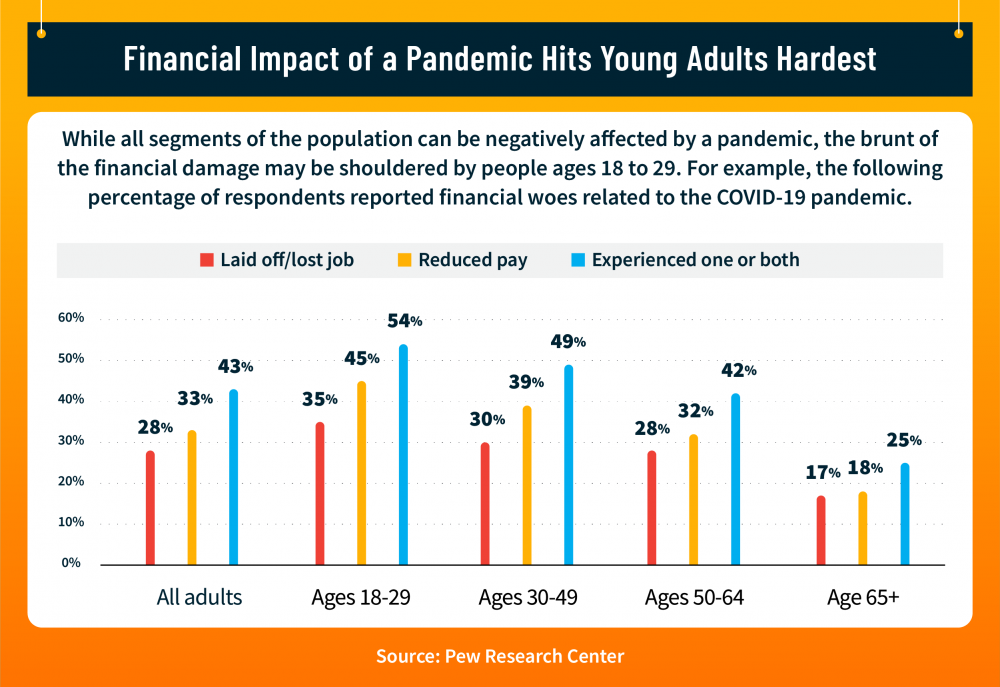

Many people worry about money. But when faced with a serious financial setback, worry can become crippling anxiety. It doesn’t take a pandemic to send people’s finances into a tailspin, but the economic turmoil that a pandemic can cause heightens the immediate need for financial therapists who are trained in helping people overcome money-related fears and reestablish control over their finances. A survey conducted by the Pew Research Center one year into the COVID-19 pandemic found many people feeling its effect:

- Of those surveyed, 51% of nonretired adults believed the economic impact of the shutdown would make it more difficult for them to achieve their financial goals.

- As of February 2021, 44% of U.S. households reported experiencing either a job loss or layoff, a pay cut, or both.

- In households that had experienced the loss of a job or reduced wages due to COVID, 62% stated that their long-term financial goals would be more difficult to achieve as a result.

- Of the people who stated that the pandemic posed a “major threat” to their finances, 34% were categorized as being in high psychological distress.

The need for counselors trained in financial planning and mental health treatment will persist long after COVID-19 is just a bad memory. By helping people explore their emotional and psychological relationship with their finances, financial therapists guide them to both financial security and mental well-being.

What Is Financial Therapy?

Financial therapy is counsel that combines financial advice and emotional support to help people manage financial stress. Worry about money and financial matters can have a crippling effect on people, negatively impacting their family life, work, and all other aspects of their lives.

The field of financial therapy arose in the aftermath of the Great Recession of 2007-2008, although its roots go back to the 1990s, when researchers began to look more closely at the psychological and emotional aspects of money. In 2019 the Financial Therapy Association (FTA) implemented its Certified Financial Therapist (CFT-I) program for both financial and mental health professionals.

One of the founders of the FTA is Rick Kahler, a financial planner and therapist whose research on people’s emotional and psychological relationship with money found that 90% of financial decisions are made emotionally. However, financial planners aren’t trained in behavioral therapy, and therapists don’t have a background in financial planning. The goal of financial therapy is to instill in people a positive attitude about their finances, which is the first step in setting and achieving financial goals.

Like many other aspects of life, when someone changes their perspective about money from negative to positive, they are more likely to think and behave in ways that allow them to build real wealth. Erika Rasure, an assistant professor for Maryville University’s online finance program, emphasizes the importance of individuals having confidence and faith in themselves to “make the right [financial] decisions no matter what life throws at you.”

Reasons Why Someone Would Need a Financial Therapist

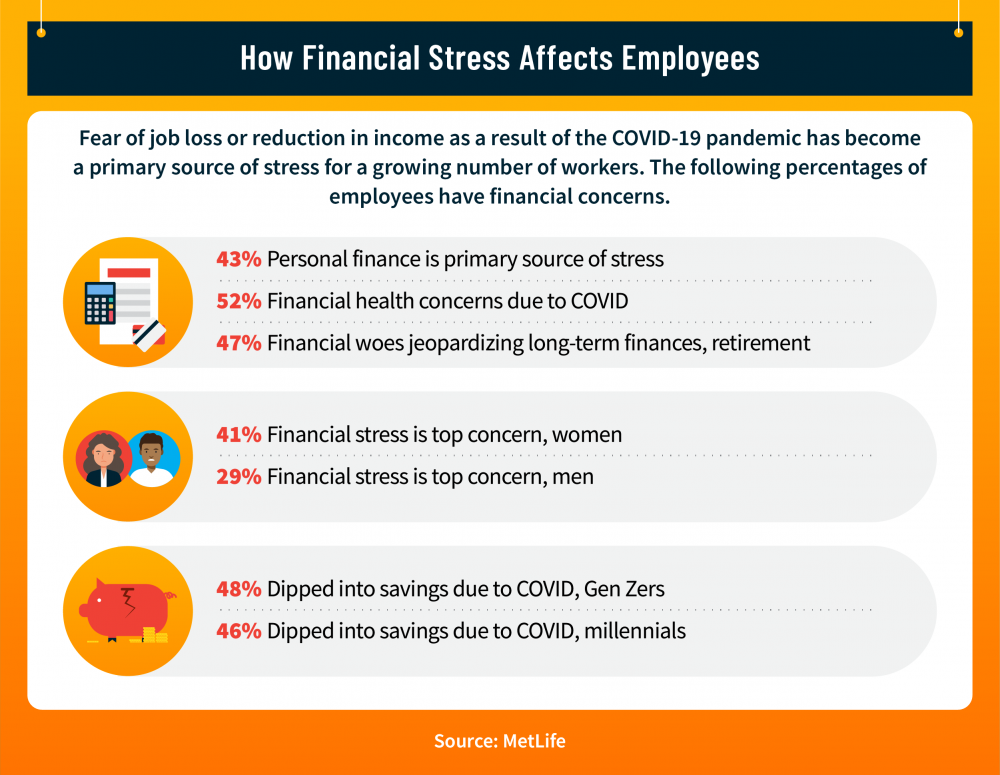

A survey conducted by financial services firm Capital One found that as of 2019, finances were the No. 1 source of stress, cited by 73% of survey respondents. People reported worrying about their finances more than politics (59%), work (49%), or family (46%). In the Capital One survey, finance-related stress was especially common among those in Generation Z (82%) and millennials (81%).

Finance-related stress only escalated during the pandemic. The Association for Financial Counseling & Planning Education (AFCPE) reported in September 2020 that the level of finance-related stress peaked in the early months of the pandemic, although they remained “extremely high” later in the year:

- Surveys conducted in April 2020 determined that 88% of respondents felt financially stressed, which dropped to 84% in a similar survey conducted in September 2020.

- The number of people who reported being extremely or very concerned about their finances similarly declined from 43% to 34% between the two surveys.

- Top financial stressors included not having enough money in savings, job security, not having sufficient retirement savings, fluctuations in income, and not being able to make housing and other monthly payments.

For many people, getting their finances in order entails working with a financial planner or financial adviser who is trained in helping them set realistic financial goals and implement plans to achieve them. However, people who experience stress and anxiety related to their finances may also need assistance to change their thinking and behavior about money, which few financial planners are trained to do.

Three scenarios in particular call for the extra guidance that a financial therapist offers:

- When a person’s relationship with money is such that they see money as a source of power and identity rather than as a tool to help them achieve their goals.

- When attitudes about money prevent taking action to improve their financial situation.

- When money issues cause a serious rift in a marriage or other personal relationships.

These are among the negative behaviors and thought patterns that financial therapy helps people overcome:

- Addressing behavioral issues that place financial and emotional well-being in jeopardy, such as gambling or compulsive shopping

- Helping people who overwork or hoard money while avoiding pressing financial matters in their lives

- Assisting people in developing healthy financial habits and addressing underlying mental or physical health problems that may contribute to poor financial management

What Does a Financial Therapist Do?

The goal of financial therapy is to help people repair financial problems and establish a sense of financial security. Financial therapists apply evidence-based practices and interventions to improve how people think, feel, and act about their finances. Much of the misunderstanding people have about money stems from the belief that money matters are rational and transactional: work in exchange for a paycheck or other remuneration, and money in exchange for goods and services.

Financial therapists instruct their clients in the emotional and psychological aspects of money management and help them identify the sources of problematic behaviors related to finances, such as compulsive spending, hoarding, overworking, gambling, and withholding financial information from a partner. In many instances, resolving the negative emotions and responses people have toward money requires the assistance of a professional trained in both mental health counseling and financial planning.

Financial Therapists Combine Counseling and Financial Planning

One reason why many people struggle to overcome unhealthy financial practices is that financial planners generally aren’t able to diagnose or treat the emotional and psychological underpinnings of bad money management, and mental health counselors tend to avoid delving too deeply into their clients’ financial situations. By combining the two disciplines, financial therapists can address the causes of a person’s money woes while also helping them devise and implement a sound financial plan.

Financial therapists typically build on their primary background in one of two areas:

- They are trained mental health counselors who pick up financial competency skills.

- They are trained financial planners who learn counseling skills.

In both instances, the goal is to help people communicate with their partners and others about the state of their finances and to replace negative emotions about money with positive ones. The techniques applied by financial therapists are designed to help their clients evaluate their spending and saving habits to identify unhealthy or problematic attitudes.

Often a person’s poor money habits have their origins in childhood. For example, someone may repeat their parent’s tendency to relieve stress or anxiety by shopping, which can result in compulsive spending. Conversely, someone who develops a compulsion for making and saving money to the point of neglecting relationships or damaging their quality of life could have experienced financial hardship or deprivation as a child that negatively affects their financial practices as an adult.

Focusing on the Psychological and Emotional Aspects of Money

Financial therapists are distinguished from financial planners in their focus on the emotions and thought processes surrounding money as opposed to a planner’s emphasis on their clients’ current and future financial situation. Consider the example of a middle school teacher from Michigan whose life was upended after inheriting millions of dollars from her parents. Her fear that she would squander the inheritance for her children and grandchildren caused her to become physically ill and bedridden.

After working with a financial therapist, the woman came to recognize that her father’s low opinion of her money-management skills caused her to see the money as a trap that she couldn’t get free of. Financial therapy helped her identify the reasons behind her negative thinking and behavior related to money.

Emotions are primary drivers of our financial decisions. We learn from our intense emotional responses and construct predictive models of the way the world works. Recent research suggests that emotional learning is flexible, which allows emotionally activated memories to be changed, or “reconsolidated.” This means that adopting new financial behaviors may reconfigure our emotional responses related to money to better align them with our financial goals.

Resources on Financial Therapists

- Financial Therapy Association, “Become a Financial Therapist” — Information about the steps required to earn CFT-ITM certification, including education, training, experience, and examination

- Huffington Post, “The Root Cause of Your Money Problems Could Be an Actual Money Disorder” — Information about money disorders, defined as any chronic pattern of self-defeating or self-destructive financial behaviors

Personal Finance Strategies That Can Help

The first step in recovering from a financial setback is to establish a budget that will help recoup losses. After finances have sufficiently recovered, the focus shifts to creating and establishing a long-term financial strategy.

To address the emotional underpinnings of financial decisions, financial therapists help their clients gain insight into the reasons for their past poor choices. They also teach behaviors that identify triggers for unwise financial habits and positive alternatives to those negative behaviors. The components of a personal finance strategy prepare their clients for challenges they may face in the short and long term:

- Develop a plan for increasing emergency savings. An emergency fund covers everything from an unexpected car repair to losing a job. It should be sufficient to pay the person’s bills for three to six months.

- Reconsider their approach to debt. Most people will at some time need to incur debt, which can often be beneficial, such as taking out a mortgage to acquire property that is likely to appreciate in value.

- Revamp their budget. The standard template for a budget that addresses short-term needs and long-term goals is 50/30/20: 50% of income is spent on essentials, 30% is devoted to discretionary expenses, and 20% is used to pay down debt and increase savings.

- Refinance their mortgage or negotiate with their landlord. When a tenant faces short-term financial difficulties, a landlord may be amenable to renegotiating the tenant’s lease. The options for renegotiating a mortgage are limited, however, and they become even more limited when the person falls behind on their mortgage payments.

- Seek lower credit-card interest rates or consolidate or transfer to lower-interest accounts. The best approach to using credit cards is to pay the balance each month. Short of that, the balance for all credit cards should be less than 30% of the person’s total available credit. The better a person’s credit rating, the easier it will be for them to negotiate a lower interest rate from their credit card company.

- Avoid situations that trigger their spending. Impulse buying can be reduced by waiting at least 24 hours (or longer) before deciding whether to purchase an item. Other suggestions include staying away from shopping areas and online shopping sites, and looking for free or inexpensive alternatives to high-priced items and activities.

Financial Struggles May Lead to Post-Traumatic Stress Disorder

Overcoming the impact of serious financial losses takes time and effort. Helping people regain their financial and emotional footing after such setbacks requires that programs designed to mitigate the effects of money woes on a person’s health, well-being, and outlook be affordable and easy to access.

The financial uncertainty created by the pandemic-related economic downturn has brought to light the psychological trauma that many people feel about their finances. Financial therapy programs that first emerged in the aftermath of the Great Recession of 2008-2009 are preparing for a deluge of people suffering from post-traumatic stress disorder (PTSD) due to financial setbacks as a result of COVID precautions.

The hope of financial therapists is that the financial shockwaves of the pandemic will lead people to rethink their relationship with money.

- Financial therapy provides individuals and couples with an opportunity to express their financial anxieties.

- By examining their negative emotions about money, people gain insight that helps them create a workable, realistic financial strategy.

- Discussing their relationship with money helps people cope with the financial aspects of their lives that they have no control over, which are the source of financial stress for many people.

- People are able to express the anger they feel about their financial situation and understand the emotions that underlie that anger as part of their recovery from financial trauma.

The feelings expressed by people who have been negatively affected by economic setbacks are identical to those of people suffering from PTSD. For example, they often note that others are suffering much worse financially than they are so they have no right to complain, mirroring the survivor guilt associated with PTSD. In extreme cases, these emotions may lead people to become overgenerous or place themselves at financial risk to assuage their feelings of guilt.

Financial therapists work with these clients to replace the guilt they experience with gratitude, so they are reminded of the positive forces in their lives. They coach their clients to help others in constructive ways, such as by offering their family and friends in financial distress a sympathetic ear and by supporting their efforts to regain their financial footing.

Resources on Managing Finances During Stressful Times

- The Balance, “5 Strategies to Deal with Financial Stress” — Advice on topics that include creating and sticking to a budget, establishing an emergency fund, and seeking the assistance of a financial planner or credit counseling service

- National Foundation for Credit Counseling, “The Mental Impact of Financial Stress and Tips for Dealing with COVID-19 Impacts” — Government programs, online resources, and tips for self-care in the aftermath of financial setbacks

Ways to Overcome Financial Anxiety

Nearly everyone worries about money on occasion, but when financial worries interfere with a person’s work life and personal relationships, they may need help to restore their productive approach to saving and spending. Professor Rasure of Maryville University points out that times of financial upheaval and uncertainty present people with an opportunity to reexamine their relationship with money and set positive, achievable goals once they overcome their money-related fears. Rasure states, “This is an excellent time to set financial goals and seek opportunities for investment that exist specifically in a market like this.”

These are among the common symptoms of financial anxiety:

- Overspending as a way to relieve stress, such as going on a spending spree that dangerously depletes savings or piles on more debt.

- Hoarding or becoming a workaholic as a way to overcompensate for the fear of running short of essentials or cash and other assets.

- Being overly miserly to the point of doing without necessities, such as medical appointments and critical home repairs, or sacrificing favorite activities and pastimes due to their expense.

- Hiding purchasing habits or financial problems from a spouse or other family member because of fear losing control over one’s money.

Financial therapists focus on teaching their clients strategies that will help them cope with financial anxiety and gain a strong economic foundation. These are some of the strategies they teach their clients to use to recognize and respond to financial stress.

- Identify their three most challenging financial matters. These may be making monthly payments on time, reducing reliance on credit cards, or saving for retirement.

- Stay positive. Acknowledge that they’re moving in the right direction even if the progress may be slow. Simply committing to their financial strategy can reduce the stress they feel.

- Devise a realistic personal finance plan and stick with it. Avoid being overly ambitious with short-term goals. Like crash diets and intense workouts, being overzealous can lead to burnout.

- Maximize their income by saving where they can. Focus on the most important budget items, such as food, housing, and healthcare. Look to save money in areas of secondary importance.

- Set a series of small financial goals that are relatively easy to achieve. Rather than looking for a single expense they can cut $500 from, they can identify 10 smaller expenses to reduce by $50 each.

- Seek the support of friends and family to help keep them on track to achieve their financial goals. By sharing financial goals with the people closest to them, they gain a cheering section to offer them encouragement in overcoming old financial challenges and new ones.

Resources on Overcoming Financial Anxiety

- First Alliance Credit Union, “How to Overcome Anxiety About Your Money” — Steps to avoiding financial stress, including a thorough review of a financial situation and setting specific, measurable, attainable, realistic, and time-bound (SMART) financial goals

- NerdWallet, “How to Cope with Financial Anxiety” — Highlights the importance of identifying and dealing with the “little-t” traumas in our lives that can quickly add up and cause “big-A” anxiety

The Ongoing Demand for Financial Therapists

The financial harm caused by catastrophes lingers long after the events themselves. Financial struggles persist, and new challenges arise that imperil our health and well-being. The need for professionals trained as counselors and financial advisers increases as individuals and families work to overcome the anxiety they feel about their finances, which can impair their work, family relationships, and all other aspects of their lives.

Financial therapy acknowledges the emotional and psychological underpinnings of our relationship with money and borrows tools and techniques from counseling and financial planning to put people on the path toward financial security.

Infographic Sources

MetLife, “How Financial Stress Is Affecting You and What to Do About It”

Be Brave

Bring us your ambition and we’ll guide you along a personalized path to a quality education that’s designed to change your life.