Tax Planning Strategies: Tips, Steps, and Resources for Planning

Taxes are a necessity. Just as you wouldn’t want to overspend on other necessities like food and housing, you don’t want to spend any more than you have to in taxes. The key to frugal shopping is to conduct research and have a spending plan. The same goes for minimizing your tax bill.

Tax planning strategies are made more important by the tax code’s complexity. First-time taxpayers may struggle to understand unfamiliar areas such as liabilities, deductions, and financial solutions for protecting assets and saving for the future.

Fortunately, a little time spent devising tax planning strategies offers many benefits beyond tax savings. The process helps individuals and small businesses manage their finances more effectively, reducing total capital outflow and putting more money in their pockets.

Tax Planning Strategies and How They Help

In addition to saving people money, tax planning strategies help taxpayers avoid tax penalties, get the most from their tax deductions, keep their financial documents organized, and plan for the future. By contrast, doing no tax planning takes money away from life’s other necessities by increasing tax bills unnecessarily.

College students are especially susceptible to unwarranted tax hits: Their parents no longer claim them as dependents on their tax returns, and they take on student loan debt. Here are some of the ways tax planning benefits college students, other individuals, and businesses, along with a look at the consequences of poor tax planning.

How Tax Planning Strategies Benefit College Students

According to data analyzed by Savingforcollege.com, 69% of baccalaureate graduates from U.S. colleges and universities in 2019 took out student loans, and their average student loan debt was $29,900. Forbes outlines four tax credits and deductions for recent college graduates and families with children in school. (A tax credit cuts the amount of tax a student has to pay, while a deduction reduces the amount of income that’s taxable.)

- American opportunity tax credit: The American opportunity tax credit (AOTC) program provides an annual tax credit of $2,500 per eligible student with qualified education expenses, such as tuition. Students who don’t owe any taxes can receive 40% of the credit, or $1,000, as a cash refund. (Note that the AOTC has a four-year maximum.)

- Lifetime learning credit: The lifetime learning credit (LLC) program provides up to $2,000 to reimburse students for tuition, fees, and other qualified education expenses. The LLC program doesn’t offer cash refunds for students with no tax liability. The program has no limit on the number of years it can be claimed.

- Tuition and fees deduction: The IRS explains that students are allowed to deduct up to $4,000 from their taxable income each year to compensate for tuition and fees. As with the LLC program, the deduction isn’t available to students who owe no taxes. Also, the deduction doesn’t apply to college costs other than tuition and fees.

- Student loan interest tax deduction: Students or parents who made payments on a qualifying student loan may deduct up to $2,500 of the interest they paid on the loan in the tax year. The deduction applies even if extra payments were made on the loan in the year.

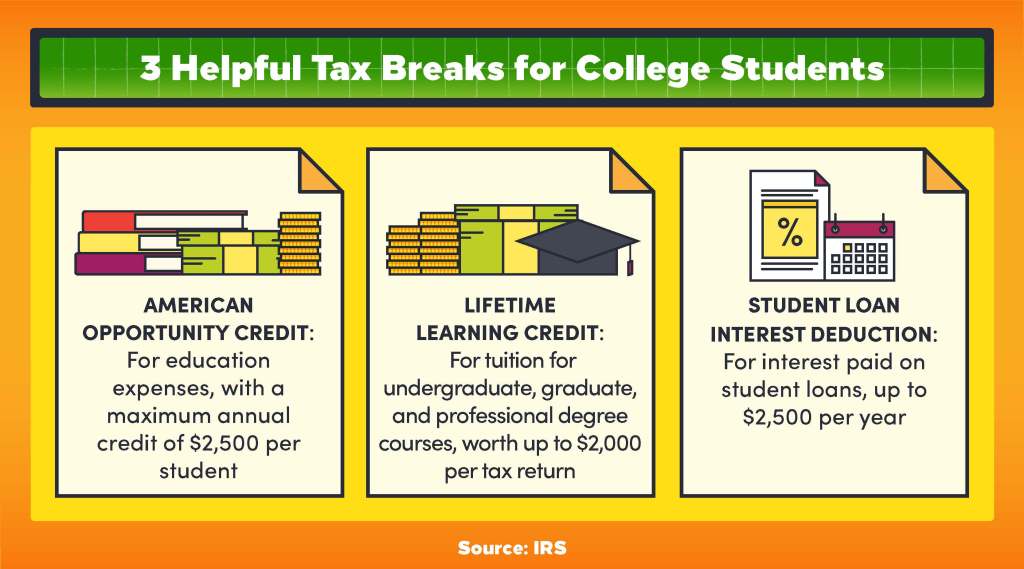

Three helpful tax breaks for college students are the American opportunity credit, which is for education expenses, with a maximum annual credit of $2,500 per student; the lifetime learning credit, which is a credit for tuition for undergraduate, graduate, and professional degree courses, worth up to $2,000 per tax return; and the student loan interest deduction, which is for interest paid on student loans, up to $2,500 per year.

How Tax Planning Strategies Benefit Other Individuals

Tax planning analyzes a person’s finances with the goal of achieving “maximum tax efficiency,” according to Investopedia. The analysis considers many factors:

- Timing of income

- Timing of purchases

- Planning expenditures

- Retirement savings strategy

- Tax filing status and deductions

A tax planning strategy becomes part of an overall plan for making expenditures and allocating retirement and other savings accounts. It allows you to be proactive in all spending and savings rather than reacting when the tax bill comes due.

How Tax Planning Strategies Benefit Businesses

Key to a small business tax strategy is understanding the four types of business taxes that the federal government levies, as The Balance explains: income tax, self-employment tax, taxes for employers, and excise taxes. Once they’ve gathered all the tax forms they require, businesses need to ensure that they’re maximizing all available deductions and tax credits:

- Small business health care tax credit: The small business health care tax credit is available to small businesses with fewer than 25 full-time equivalent employees. The average employee salary is generally $50,000 or less, and the business must pay at least 50% of employees’ health insurance premiums. Coverage must be offered to all full-time employees.

- Work opportunity tax credit: Companies that employ people who are among the groups facing significant employment barriers can claim the work opportunity tax credit. Among the groups are qualified veterans, former prisoners, vocational rehabilitation referrals, Supplemental Nutrition Assistance Program (SNAP) recipients, and long-term family assistance recipients.

- Coronavirus tax relief: Among the programs designed to provide relief for businesses that COVID-19 has impacted are the employee retention credit, the Families First Coronavirus Response Act, and the net operating loss (NOL) carrybacks of C corporations.

The Consequences of Failing to Plan for Taxes

Individuals and businesses risk more than a higher-than-necessary tax bill by not putting a tax planning strategy in place. Should they fail to make a tax payment on time, the IRS imposes penalties and interest on the unpaid amount until the balance is paid in full. The IRS levies penalties for several reasons:

- Failure to file

- Failure to pay on time

- Failure to pay appropriate estimated tax

- Dishonored check

For small businesses and self-employed workers, the IRS offers relief for some penalties in cases in which an effort was made to comply with tax requirements but the tax obligation wasn’t met because of circumstances beyond the taxpayer’s control. These are among the penalties that may qualify for relief:

- Failure to file a tax return

- Failure to pay on time

- Failure to meet the requirement to deposit certain taxes

Tax Planning Strategies for Individuals

The adage “Watch the pennies and the dollars will take care of themselves” applies doubly to tax planning strategies for individuals. College students, recent graduates, and others struggling to make ends meet can reduce their tax obligations by taking advantage of tax-saving opportunities available to people in all income categories.

Know Your Dependency Status

The IRS defines a dependent as a qualifying child or qualifying relative:

- A dependent child is a son, daughter, stepchild, foster child, brother, sister, half-brother, or half-sister under age 19 at the end of the tax year, or under age 24 if a student, who is younger than the tax filer.

- To qualify as a dependent child, the person must have lived with the filer for more than half of the year, received more than half of support from the filer, and can’t file a joint return except to claim a refund of tax withheld or estimated tax paid.

- A dependent relative must be related to the filer in one of several different ways, must live with the filer for the entire year, and must have a gross income for the year of less than $4,200.

- The filer must provide more than half of the dependent relative’s total support for the year.

Three tests must be met for the qualifying child or qualifying relative to be claimable as a dependent:

- Dependent taxpayer test: A taxpayer who someone claims as a dependent can’t claim anyone else as a dependent.

- Joint return test: Someone can’t claim a married person as a dependent if the married person files a joint return, except to claim a refund of income tax withheld or an estimated tax payment.

- Citizen or resident test: Only U.S. citizens, resident aliens, U.S. nationals, or Canadian or Mexican residents can be claimed as dependents except for adopted children.

Gather All Required Tax Forms

While many college students and other individual and joint filers will use Form 1040-EZ to complete their tax returns, many people can reduce their tax bills by filing the long Form 1040 along with other standard IRS tax forms. The tax forms that may be required to file an individual or a joint tax return include the following:

- Form 1040, U.S. Individual Income Tax Return

- Form 1040-V, Payment Voucher

- Form 1040-ES, Estimated Tax Payments

- Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Schedule A, Itemized Deductions

- Schedule C, Profit or Loss from Business (Sole Proprietorship)

- Form 1098-T, Tuition Statement

- Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits)

- Form 8917, Tuition and Fees Deduction

Understand Tuition Tax Credits and Student Loan Interest Deductions

The IRS explains the differences between its AOTC and LLC programs that offer education credits to students and their parents:

- The AOTC includes credits for such school expenses as course-related books, supplies, and equipment that students require but schools don’t pay for, while the LLC applies only to tuition, fees, and other qualified education expenses.

- The AOTC is available for four years only, while the LLC can be used for any number of years.

- The AOTC has a modified adjusted gross income (MAGI) limit of $80,000 if filing individually and $160,000 if filing jointly. For LLC, the MAGI limit is $68,000 if filing individually and $136,000 if filing jointly.

For student loan interest deductions, the maximum deduction is the lesser of $2,500 or the actual amount of interest the person paid in the year. The deduction amount decreases and is ultimately phased out as the person’s MAGI reaches the annual limit for the filing status. The deduction is claimed as an adjustment to income, thus eliminating the need to itemize deductions to qualify for it.

Know the Tax Requirements for Your Home State and School State

For most college students, their home states remain where their families reside even if they attend out-of-state schools. Intuit explains how to determine your home state for federal tax purposes:

- The residence shown on your driver’s license

- The state where your vehicle is registered

- The state where you’re registered to vote

- The state where you own property

However, if out-of-state students earned income in the states where they attend school, they may need to file nonresident state tax returns and pay income taxes to the states. The students may also need to file state tax returns in their home states, but they’ll receive credit for any income taxes they pay to another state.

Resources for Individual Tax Planning Strategies

- S. Internal Revenue Service, Tax Information for Students — Links to complete the Free Application for Federal Student Aid (FAFSA), filing instructions, and higher education tax benefits.

- S. Internal Revenue Service, Credits and Deductions for Individuals — Detailed descriptions of various tax credits and deductions available to individuals.

- S. Internal Revenue Service, Good Tax Planning Includes Good Recordkeeping — Tips for keeping tax records well organized.

Small Business Tax Planning Strategies

Tax planning isn’t likely to be at the top of the to-do list for someone starting a business. However, small business tax planning strategies can spell the difference between success and failure for old and new businesses alike. Following are some topics that business owners need to keep in mind when preparing to meet their tax obligations, whether they handle their taxes internally or outsource their tax planning.

Tax Planning Strategies for New Businesses

New businesses need to be aware of the taxes they may be subject to, as Inc. explains:

- Income taxes: In addition to federal income tax, most businesses will be responsible for state income taxes. The taxes apply to C corporations, in which the business pays the tax; sole proprietorships; partnerships; limited liability companies; and S corporations, in which the owners are responsible for income taxes.

- Employment taxes: Any business that hires employees must withhold income taxes and the employees’ share of Social Security and Medicare (FICA) taxes. The business is responsible for its share of FICA taxes as well as state and federal unemployment taxes.

- Sales taxes: Any goods or services that are sold in a state that applies a sales tax require that the business collect the tax from customers at the time of the transaction. The state may levy penalties against businesses that fail to collect the sales taxes.

- Excise taxes: Some businesses may have to pay excise taxes for their use of fuel, highway use by trucks, and other activities.

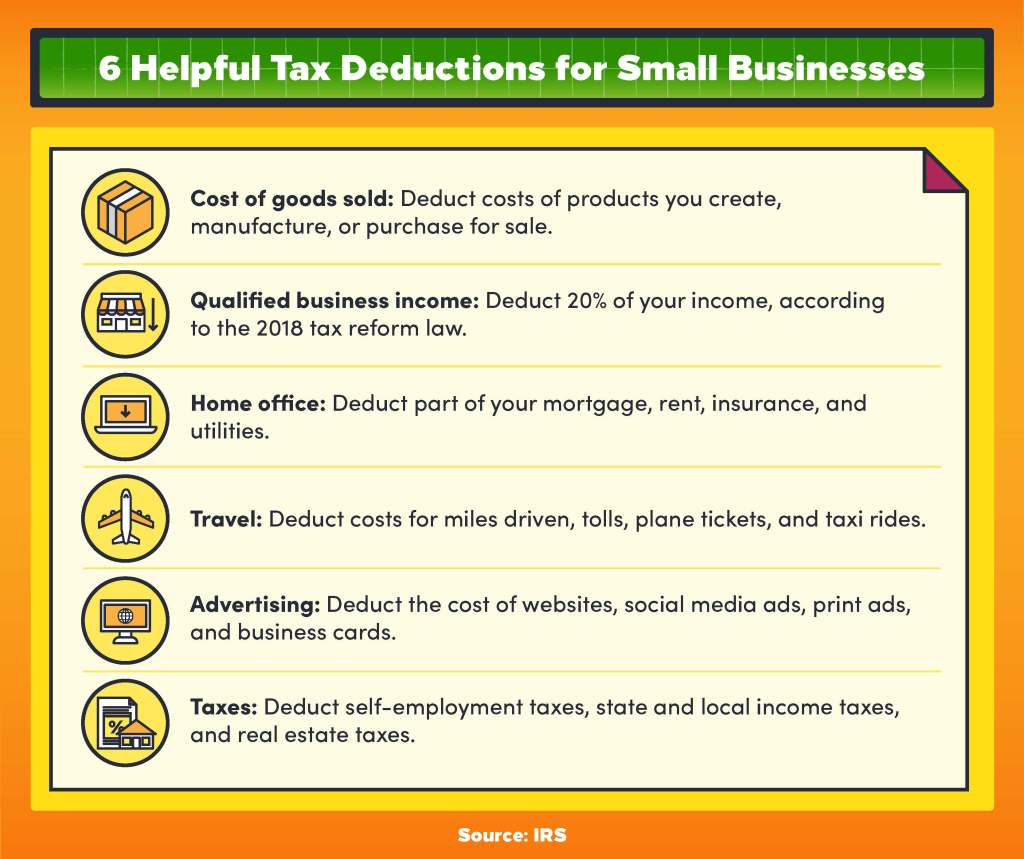

Six helpful tax deductions for small businesses are cost of goods sold, in which you deduct costs of products you create, manufacture, or purchase for sale; qualified business income, where you deduct 20% of your income, according to the 2018 tax reform law; home office, in which you deduct part of your mortgage, rent, insurance, and utilities; travel, where you deduct costs for miles driven, tolls, plane tickets, and taxi rides; advertising, or deducting the cost of websites, social media ads, print ads, and business cards; and taxes, where you deduct self-employment taxes, state and local income taxes, and real estate taxes.

Business Property Deductions

Among the deductions the IRS allows businesses to take are those for rent payments on properties that the businesses don’t own, unless they receive equity in or titles to the properties. For home-based businesses, expenses for the use of the home may be deducted, including a percentage of mortgage interest, insurance, utilities, repairs, and depreciation.

Similarly, business use of a privately owned vehicle may allow for the vehicle’s expenses to be deducted on the business’s tax return. Only the mileage attributable to business use qualifies for the deduction, which is based on miles driven and varies from year to year.

Tracking Income and Expenses

The IRS lists the type of records that small businesses and self-employed individuals need to keep for tax purposes:

- Gross receipts: This category includes cash register tapes, deposit information, receipt books, invoices, and Form 1099-MISC entries.

- Purchases and expenses: This category includes canceled checks and other proofs of payment, cash register tape receipts, invoices, and credit card receipts and statements.

- Travel, transportation, entertainment, and gifts: Deductions in this category must be substantiated under guidelines explained in IRS Publication 463, which covers topics such as how to use the standard mileage rate.

- Assets: This category includes information about the property that the business owns, including date of purchase, price, cost of improvements, deductions taken, how it’s used, and how it’s disposed of (resale price, etc.).

- Employment taxes: Specific employment tax records must be kept for four years, as explained in IRS Publication 15 and Employment Tax Recordkeeping.

Contributing to a Retirement Plan

The IRS describes the benefits for small business owners who contribute to retirement plans for themselves and their employees:

- Businesses can deduct retirement contributions from taxable income.

- The assets are able to grow tax-free.

- Retirement plans offer businesses many options for how and when they contribute.

- Starting a plan allows businesses to qualify for credits covering some of the implementation costs.

- Retirement plans help employers attract and retain qualified employees.

The IRS provides information that describes the types of retirement plans and retirement plans for small businesses, such as simplified employee pension (SEP) plans, as well as tips for choosing a retirement plan for a small business.

Restructuring Your Business

The IRS requires that businesses capitalize any improvement costs, but maintenance costs that don’t improve the business, such as lighting or plumbing repair, can be deducted as business expenses. However, when businesses reorganize, they must pay a one-time restructuring charge, as Investopedia explains.

Typical scenarios in which the restructuring charge applies include acquisitions, downsizing, relocating, consolidating debt, and writing off assets. Restructuring expenses are considered nonrecurring operating costs. While tax-deductible costs include starting or acquiring a new business, restructuring costs are immediately deductible only if the transaction isn’t completed.

Resources for Small Business Tax Planning Strategies

- S. Internal Revenue Service, Small Business and Self-Employed Tax Center — Information for those filing Form 1040 or 1040-SR; Form 2106; and Schedule C, E, or F.

- S. Internal Revenue Service, Deducting Business Expenses — An explanation of all categories of deductions available to small businesses and self-employed individuals.

- S. Small Business Administration, Tax Planning and Reporting for a Small Business — A guide including a pretest and a self-test for small business tax planning requirements.

Advanced Tax Planning Strategies and Tips

Tax planning’s benefits extend beyond the current tax year and accrue over time. Forbes describes five advanced tax planning strategies that offer big payoffs in the future.

- Property investment: Real estate tax advantages have benefited long-standing businesses and generations of families. However, many of the benefits require being classified by the IRS as a real estate professional.

- Business purchase: While a purchased business must earnestly seek to make a profit, it provides leverage for legitimate deductions that would otherwise be taxable.

- Roth 401(k): A Roth 401(k) can be used in ways that don’t apply to a Roth IRA; for instance, a Roth 401(k) may be used for funneling real estate appreciation and rents that would otherwise be taxable.

- Smart qualified plans: Businesses can save on taxes by using an SEP and a savings incentive match plan for employees (SIMPLE) to fund tax-deductible retirement plans, which can increase tax-free contributions by as much as $150,000.

Deducting More Complex Expenses

Taxpayers who itemize rather than take the standard deductions for their tax brackets need to know whether they qualify for any tax deductions and credits the IRS offers. NerdWallet lists the most common deductions and credits for individuals.

- The child tax credit offers up to $2,000 per child age 16 or younger who qualifies as a dependent, while the child and dependent care credit pays 20% to 35% of child care or similar costs for a child under age 13, up to $3,000 (up to $6,000 for two or more dependent children).

- The earned income tax credit provides low- and moderate-income taxpayers with a refundable tax credit that in 2020 ranges from $538 to $6,660.

- The retirement savings contribution credit, or “saver’s credit,” is available to anyone over age 18 who isn’t claimed as a dependent on another person’s tax return. If a person’s adjusted gross income is below a certain threshold, tax savings can be worth up to $1,000, depending on the contribution to a qualified retirement plan.

Adding Employee Benefits

Businesses can deduct the cost of providing certain benefits to their employees, including health plans and gifts. The Balance Small Business describes the employee benefits that companies can deduct from their taxes.

- Bonuses, sick pay, vacation pay, advances, and loans

- Commuting reimbursements, such as van pools, transit passes, parking, and bicycle commuting

- Education assistance expenses (deductible in part, although some employees, owners, and family members are excluded)

- Fringe benefits, such as accident and health plans, dependent care assistance, cafeteria plans, life insurance, and adoption assistance

Note that employee awards, such as gift cards, gift certificates, sporting event tickets, meals, lodging, vacations, and securities, aren’t tax deductible.

Importance of Tax Planning

For individuals and businesses alike, the key to achieving their goals is planning. Tax planning’s importance is evident in the amount of money that can be saved by taking steps to minimize the tax burden. Those steps will change as a business grows or a person advances in a career. However, the need for careful strategic tax planning remains from beginning to end.

Examples of Beneficial Tax Planning Strategies

The sooner you begin developing a strategic tax plan, the quicker you can realize the benefits. Financial services firm Brady Ware describes four scenarios in which a specific tax planning strategy paid dividends.

- Contribution bunching: By combining charitable contributions in specific tax years, filers can take the itemized deductions in some years while taking the higher standard deduction in other years.

- 529 plan: A 529 plan is a tax-advantaged savings plan, as Investopedia explains. Common types are tax-deferred savings plans that allow tax-free withdrawals for qualified education expenses, and prepaid tuition plans for participating colleges and universities that lock in current tuition rates. (Note that the plans are run by states, so rules vary based on jurisdiction.)

- Entity structure for self-employed individuals: One-person businesses that start as limited liability corporations (LLCs) make the owner responsible for all tax liabilities. By restructuring as an S corporation, which is a flow-through entity, the business avoids double taxation. Owners and investors are taxed only for revenue rather than for the value of the business.

- Required minimum distributions: Anyone over 70 and a half years old who has an inherited individual retirement account must take the required minimum distribution by December 31 of the tax year. If less than the full required distribution is taken, the person could be subject to a 50% excise tax on the unpaid portion.

How Lack of Planning Can Raise Your Tax Bill

Every December, some taxpayers rush to find ways to reduce their tax bills for the year. USA.gov provides a rundown on recent tax law changes, including which tax breaks are being extended, late changes in tax forms and instructions, and changes in fees and deductions.

- The IRS describes the impact of recent COVID-19 legislation on employment taxes.

- The IRS also explains changes to retirement plans as a result of COVID-19.

- Investopedia provides guidance to taxpayers who are planning their 2020 taxes, including whether stimulus payments are taxable, changes to tax brackets and rates, and increases in standard deductions.

- The IRS examines the impact of recent tax reforms on business taxpayers, such as the need to recalculate estimated tax payments, and revisions and additions to business tax deductions.

No business or individual can expect to achieve success without having well-thought-out plans that include strategies for minimizing their tax bills. The key is to have a tax planning strategy that’s thorough but also flexible enough to adapt as economic, social, and political conditions change. A tax plan that’s complete and up to date will pay bountiful rewards today and tomorrow.

Infographic Sources

IRS, American Opportunity Tax Credit