Entrepreneurship Statistics: Current Success and Looking Ahead

Tables of Contents

One unexpected — and positive — impact of the COVID-19 pandemic is a steep rise in the number of people choosing to start a business.

- The U.S. Census Bureau reports that the number of new business applications and formations increased by 24% in 2020, the largest year-to-year increase in the 15 years the bureau has tracked them.

- The trend marks the end of a 40-year decline in entrepreneurship in the U.S., according to The New York Times, which notes that in 1980, new businesses employed 12% of workers, compared with only 8% in 2018, the most recent year for which data is available.

Entrepreneurship is one of the major factors driving economic growth and spurring innovation. A rise in new businesses can be a major contributor to economic stability and increased productivity. It also promises to make the U.S. economy more resilient when downturns occur.

While the trend is too new to signal an impending surge in economic activity, analysts note that new businesses have been concentrated in the industries that suffered the most during the pandemic, including retail, food services, and logistics. Entrepreneurial activity has also increased among manufacturing, finance, construction, and other major sectors of the economy, according to The New York Times.

Succeeding as an entrepreneur begins with an idea, but turning a brilliant concept into a thriving business requires a diverse range of skills, experience, and characteristics. Abundant opportunities await entrepreneurs with the determination and willingness to strike out on their own. Consider the outlook for burgeoning entrepreneurs who are ready to convert their million-dollar idea into a physical or digital reality.

Entrepreneurs’ Job Description

Entrepreneurs convert a creative idea about how to fulfill a commercial need in the community and make a profit doing so. Many small business owners succeed without education beyond high school, but an advanced degree increases an entrepreneur’s earning potential, as data from the employment site Zippia indicates.

- 62% of entrepreneurs have a bachelor’s degree.

- 14% have an associate degree.

- 11% have a master’s degree.

- 6% have only a high school diploma.

The site reports that postgraduate education translates into higher income:

- Entrepreneurs who have a master’s degree earn a median annual salary of about $152,000.

- Entrepreneurs who have a bachelor’s degree earn a median annual salary about $114,000.

- Entrepreneurs with an associate degree or some college earn a median annual salary of about $97,000.

Being an entrepreneur requires knowing how to multitask and play many roles, including marketing, finance, personnel management, and professional networking. The job site Indeed identifies 10 roles that entrepreneurs typically fill while getting a new enterprise off the ground and making it profitable.

- Being a business leader: Creative thinking, problem solving, conflict management, decision-making, and example setting are all important parts of leading a business, no matter its size or type of operation.

- Allocating duties and responsibilities: Entrepreneurs choose a business’s organization, including implementation and management of the processes it’ll use to meet its goals.

- Anticipating change: Markets and economic conditions never stay the same for long, and business owners have to be prepared to respond quickly to unexpected changes in their markets and in the world.

- Creating jobs: Employees need to be motivated in addition to being managed, so it’s important to take the time to communicate the company’s goals and mission.

- Identifying business opportunities: Entrepreneurs benefit from listening closely to their customers and looking for ways to capitalize on their needs.

- Creating wealth for themselves and others: Whether entrepreneurs receive financial backing from family and acquaintances or from a commercial lender, the business’s profits ultimately benefit the community.

- Making the world a (little bit) better place: Every business fulfills a purpose for its customers in its own inimitable way and has the potential to generate goodwill with its clients and partners.

- Reducing risk: Before starting a business venture, entrepreneurs look carefully at the challenges and potential pitfalls they may have to overcome, including insuring the operation and keeping employees safe.

- Building partnerships: The business has to create an environment in which partners and potential partners can thrive and share in one another’s success.

- Taking advantage of tech innovations: Part of an entrepreneur’s risk reduction strategy is staying up to date on new technologies that may either disrupt the operation or create new opportunities for it (or both).

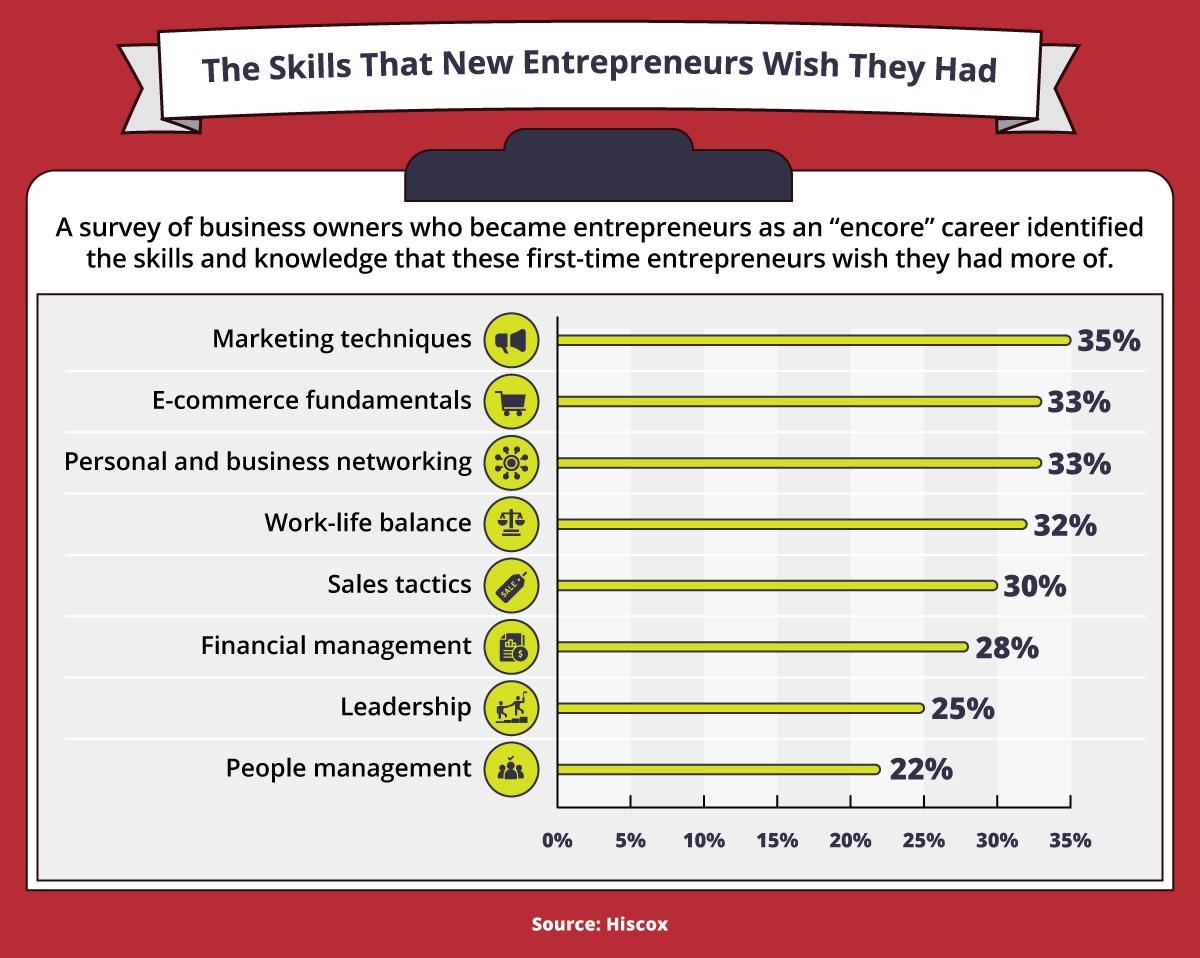

A Hiscox survey of business owners who became entrepreneurs as an “encore” career identified the skills and knowledge that these first-time entrepreneurs wish they had more of. Marketing techniques: 35%. E-commerce fundamentals: 33%. Personal and business networking: 33%. Work-life balance: 32%. Sales tactics: 30%. Financial management: 28%. Leadership: 25%. People management: 22%.

Attributes of Successful Entrepreneurs

Just as every business is unique, every business starter brings a unique mix of characteristics, experience, and skills. While no single entrepreneur template exists that describes the ideal businessperson, entrepreneurs frequently share a handful of attributes. Forbes notes several traits that successful entrepreneurs share.

Drive

Entrepreneurs need to inspire others: customers, employees, partners, and community members. Inspiring others requires that entrepreneurs be inspired themselves, whether by the potential of their business idea or the opportunity to gain knowledge, grow, and be creative with a purpose. That inspiration translates into the drive that keeps the business moving toward its goals.

Resilience

Entrepreneurs understand that even the most exhaustive research can’t prepare a business for unstable market conditions, changes in customer preferences, and other unpleasant surprises. They remain steadfast when unforeseen circumstances necessitate that the business adapt, realign, or reinvent itself in the face of challenges and setbacks.

Creativity

Starting a business often requires creative approaches to overcoming obstacles, whether they involve products, business processes, marketing, or finance. Often, new technologies, such as mobile apps, wireless devices, and social media, can be applied in ways that broaden the reach of marketing efforts and allow a business to operate more efficiently.

Strong Professional Networks

Businesses are built on solid personal and business relationships. Entrepreneurs work hard to meet other business leaders in their industry and connect with professionals and community members from a range of backgrounds to learn and discover opportunities. They also appreciate the importance of making the effort to maintain those vital business connections.

Vision

An entrepreneur’s workday is filled with details that need to be addressed to keep the business running, but business owners also have to maintain a broader perspective. Taking a macro view of the operation lets entrepreneurs see how the pieces fit together and motivate people to help realize the company’s vision.

Entrepreneurship Statistics

The 2021 survey of small business trends from Guidant Financial and the Small Business Trends Alliance (SBTA) highlights a significant trend among people starting a business: more small business owners are now members of Generation X (46%) than the baby boom generation (41%). In addition, 13% of small businesses were started by millennials, and 1% by Gen Z, or “Zoomers.”

These are the primary reasons small business owners choose to become an entrepreneur, according to the survey:

- To become their own boss: 29%

- Dissatisfaction with corporate life: 17%

- To pursue their passion: 16%

- The opportunity presented itself: 12%

- Inspiration for new business: 9%

- Not ready to retire: 7%

- Laid off or job outsourced: 7%

While 31% of the businesses surveyed have been open for 10 years or more, 19% have been in business for one year or less, and an additional 19% for two or three years.

U.S. Entrepreneurship Statistics

Entrepreneurship in the U.S. is getting a boost from the “Great Resignation” that has seen more people quit their jobs in 2021 than ever before:

- The U.S. Department of Labor reports that in September 2021 the number of people who quit their jobs reached 4.4 million, the largest number ever recorded in the 20 years the department has tracked job separations.

- The September 2021 resignations mark an increase of 164,000 from the number of resignations recorded in August 2021, the previous monthly high.

- Almost 1 million of the September 2021 resignations were in the leisure and hospitality industry, which is struggling to recover from COVID-related slowdowns, as The New York Times

A Digital.com survey indicates that 32% of people who quit their job in 2021 did so to start their own business, and 60% of these people spent time during the COVID lockdown to learn about starting and running a business. The reasons that the survey respondents gave for wanting to start a business were to be their own boss (62%), pursue their passion (60%), fill a need in their community (52%), build wealth (51%), and create jobs (42%).

Fit Small Business reports on the five industries that have the most small businesses:

- Food and restaurant: 12% of all small businesses

- Retail: 11%

- Business services: 11%

- Health, beauty, and fitness services: 9%

- Residential and commercial services: 7%

Female Entrepreneurship Statistics

The National Women’s Law Center reports that since the start of the COVID-19 pandemic, more than 2.3 million women have left the labor force, causing women’s participation to decline to 57% in February 2021 from 59.2% before the pandemic. (By comparison, some 1.8 million men left the labor force and the participation rate for men fell to 69.6% in February 2021 from 71.6% one year earlier.) This marks the lowest rate of labor force participation by women since 1988.

However, declining employment rates for women have led to more women striking out on their own as entrepreneurs, as Forbes reports. As companies redeploy their workforces in response to COVID-19 restrictions, they rely more on contingent workers, such as contractors, freelancers, and other gig workers. This creates an opportunity for female entrepreneurs to gain a foothold with firms by taking over roles that employees previously filled.

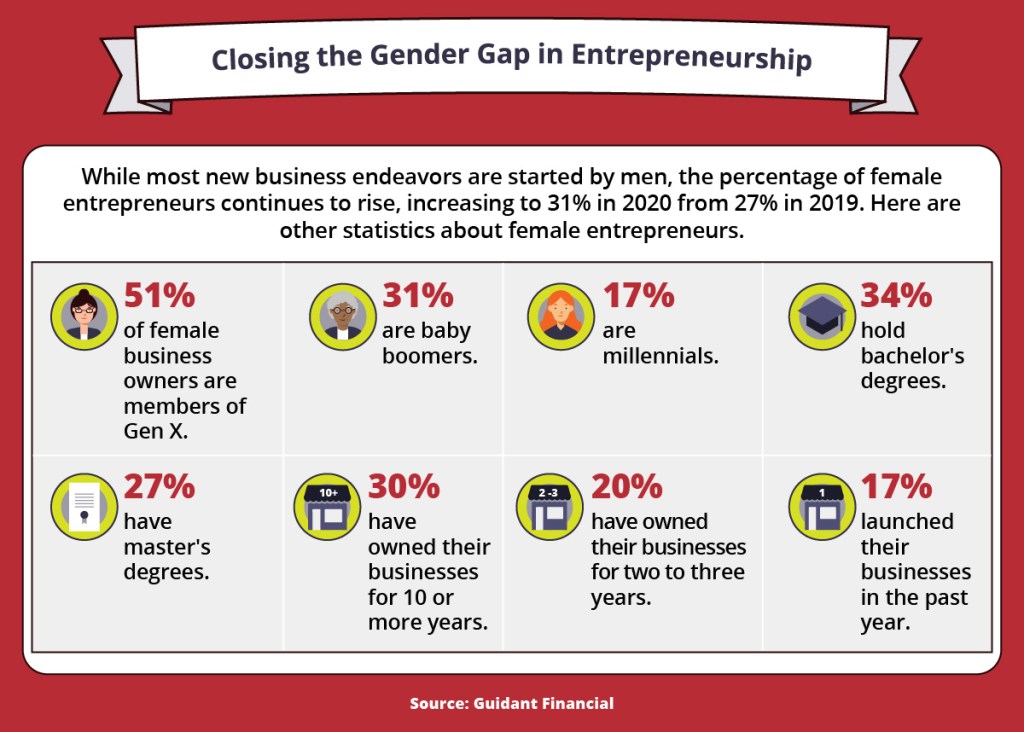

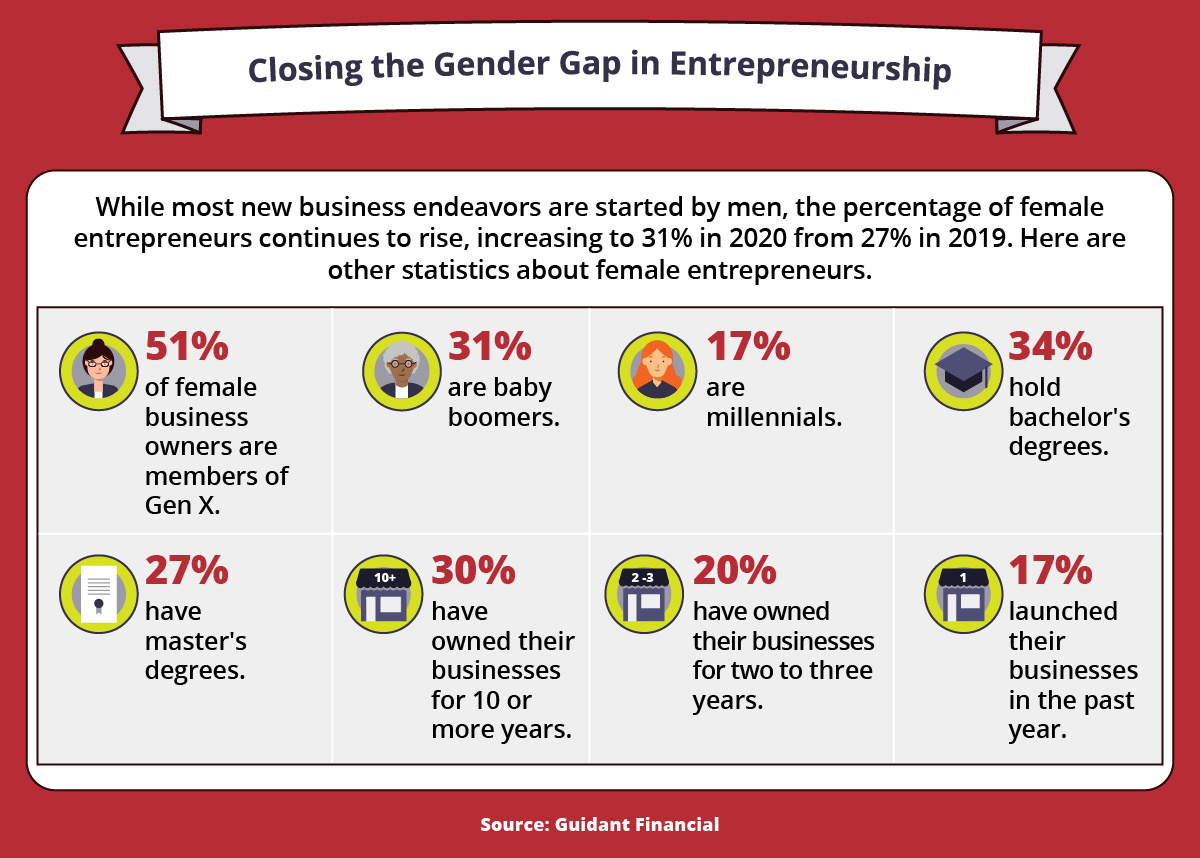

While most new business endeavors are started by men, the percentage of female entrepreneurs continues to rise, increasing to 31% in 2020 from 27% in 2019. Here are other statistics about female entrepreneurs from Guidant Financial: 51% of female business owners are members of Gen X; 31% are baby boomers; 17% are millennials; 34% hold bachelor’s degrees; 27% have master’s degrees; 30% have owned their businesses for 10 or more years; 20% have owned their businesses for two to three years; and 17% launched their businesses in the past year.

American Express’s 2019 State of Women-Owned Business Report (the most recent year the survey was conducted) provides a snapshot of the state of female entrepreneurship in the U.S.

- Women-owned businesses represent 42% of all enterprises in the U.S.

- The share of total employment held by women-owned businesses increased the most in these five industries between 2014 and 2019:

- Healthcare and social assistance: 14% increase

- Accommodation and food services: 11%

- Professional, scientific, and technical services: 11%

- Educational services: 10%

- Transportation and warehousing: 10%

- Growth rates for women-owned firms between 2014 and 2019 outpaced those for all other businesses:

- Number of women-owned firms: 21% increase

- Number of all firms: 9% increase

- Employment at women-owned firms: 8% increase

- Employment at all firms: 1.8% increase

- Revenue growth at women-owned firms: 21% increase

- Revenue growth at all firms: 20%

Black Entrepreneurship Statistics

The COVID-19 pandemic has also caused a surge in the number of Black business owners, as Bloomberg reports. In August 2021, the number of Black-owned businesses reached 1.5 million, a 38% increase from February 2020. By comparison, the number of Hispanic/Latinx-owned businesses increased by 15%, the number of white-owned businesses by 3%, and the number Asian American-owned businesses by 2%.

Black entrepreneurs are an essential part of the economy, as the 2021 survey of Black entrepreneurs from Guidant Financial and the SBTA indicates. Black small business owners tend to be younger than their white counterparts, for example, and a larger percentage of Black business owners are women (46%), which is 53% higher than the percentage of white women business owners.

- Black entrepreneurs by generation:

- Gen X: 49%

- Baby boomers: 27%

- Millennials: 21%

- Gen Z: 3%

- Black entrepreneurs’ financing methods:

- Cash: 43%

- Rollover as Business Start-up (ROBS): 14%

- Line of credit: 11%

- Small Business Administration loan: 9%

- Family/friends: 8%

- Non-COVID challenges Black entrepreneurs face:

- Lack of capital/cash flow

- Marketing/advertising

- Recruitment and retention of employees

- Administration

- Managing/providing benefits

Immigrant Entrepreneurship Statistics

A report from SCORE titled Unsung Entrepreneurs notes that first-generation or immigrant entrepreneurs are one of the three groups, along with veteran entrepreneurs and encore entrepreneurs (aged 55 and older), that make the largest contribution to the small business economy.

- Immigrants represent 13.2% of the U.S. population, yet account for 20.6% of all business owners.

- Veterans account for 7.6% of the population and own 9.1% of all U.S. businesses.

- While only 21% of the U.S. population is 55 or older, it includes 50.9% of all business owners.

The percentage of immigrant entrepreneurs has increased from 13.3% of new business owners in 1996 to 25.4% of new businesses in 2019, according to the SCORE report. Immigrant-owned businesses are also more likely to plan for additional hires than their native counterparts, and while they’re more likely to apply for financial support, they’re less likely to receive it.

- Immigrant entrepreneurs cite job discrimination as a reason for starting their business 52.6% more often than other entrepreneurs.

- Immigrant entrepreneurs are more likely to be concerned about finding financing (43%) than nonimmigrant business owners (31.6%).

- When applying for financial support, immigrant entrepreneurs have their applications rejected 72% to 83.5% more often than nonimmigrant business owners.

Small Business Entrepreneurship Statistics

Numbers released by the U.S. Small Business Administration (SBA) in November 2021 indicated that two key factors for measuring small business success — self-employment and proprietors’ income — declined sharply in 2020 as a result of COVID-19 but have bounced back rapidly in 2021. Similarly, business openings and closures both reached record highs in 2020, but total openings outpaced total closings by the end of the year.

The SBA reports that the total number of small businesses in the U.S. is about 35.2 million, 81% of which have no employees (nonemployer firms).

- Small businesses employ 46.8% of private sector workers, representing 61 million jobs.

- They account for 43.5% of gross domestic product (GDP).

- They represent 39.7% of private sector payroll and 35.6% of private sector receipts, or $13 trillion.

- Between 1995 and 2020, small businesses created 12.7 million net new jobs, compared with 7.9 million for large businesses.

- Between 1994 and 2019, 67.6% of new employer establishments had survived at least two years, 48.9% had lasted at least five years, 33.6% were in business at least 10 years, and 25.7% had been operating for at least 15 years.

The average number of employees that a new business hired in 2019 was 3.3, compared with 15.3 employees on average for all existing businesses. The most common source of financing for small businesses was business earnings (77%), although by the end of 2020, 73% of small single-location employer businesses had received financial aid from the Paycheck Protection Program.

Resources for Prospective Entrepreneurs

- Embroker, 70+ Essential Entrepreneur Statistics in 2021 — Among the categories of statistics presented are entrepreneur demographics, entrepreneurship success, and tips for entrepreneurs.

- Findstack, “The Ultimate List of Entrepreneur Statistics 2021” — Statistics include the number of millionaire entrepreneurs, the most popular sources of advice for entrepreneurs, and the reasons that 20% of small businesses fail in their first year.

- Nasdaq, “An Entrepreneurial Boom Could Be Looming” — The article explains that the experience of working from home during the pandemic has caused many people to sour on the constraints of being an employee.

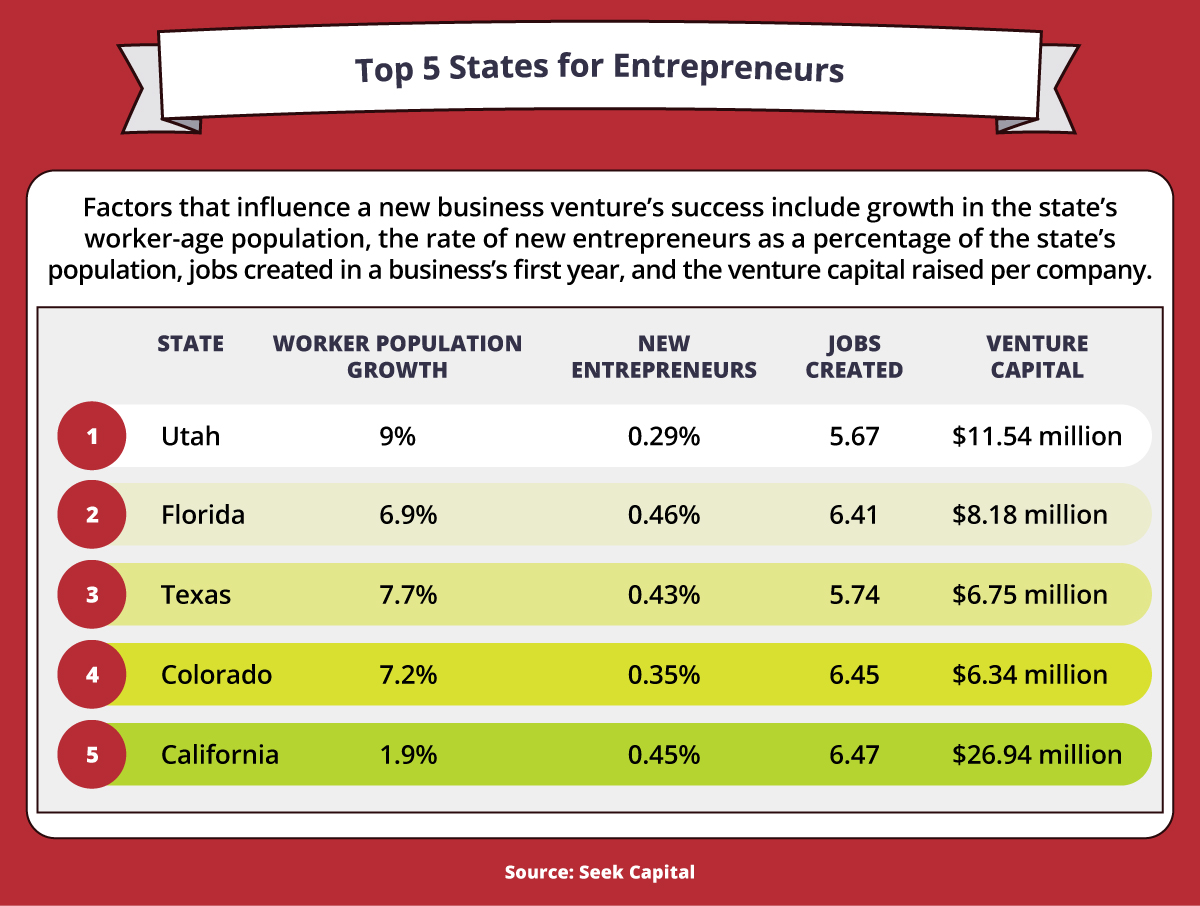

According to Seek Capital, factors that influence a new business venture’s success include growth in the state’s worker-age population, the rate of new entrepreneurs as a percentage of the state’s population, jobs created in a business’s first year, and the venture capital raised per company. Top states for entrepreneurs include: 1. Utah: 9% worker population growth; 0.29% new entrepreneurs; 5.67 jobs created; and $11.54 million venture capital. 2. Florida: 6.9% worker population growth; 0.46% new entrepreneurs; 6.41 jobs created; and $8.18 million venture capital. 3. Texas: 7.7% worker population growth; 0.43% new entrepreneurs; 5.74 jobs created; and $6.75 million venture capital. 4. Colorado: 7.2% worker population growth; 0.35% new entrepreneurs; 6.45 jobs created; and $6.34 million venture capital. 5. California: 1.9% worker population growth; 0.45% new entrepreneurs; 6.47 jobs created; and $26.94 million venture capital.

How Much Do Entrepreneurs Make?

The factors that determine how much an entrepreneur makes include the level of experience, the type of business, the amount of revenue the business is generating, and the business’s current cash flow. New business owners typically earn very little to begin with, choosing instead to reinvest in the business as much as possible. However, in almost all cases entrepreneurs receive regular compensation in some way.

The salary site PayScale estimates that a small business owner earned a median annual salary of about $65,000 as of November 2021; those with less than one year of experience earned about $31,000, and those with 20 or more years of experience earned about $76,000. Among the skills that affected a small business owner’s salary are sales management (about 85% higher salary than average), construction estimating (50%), and accounting (35%).

At the other end of the scale, many entrepreneurs serve as CEOs, general managers, or administrators of their business, qualifying them to be paid as top executives. The U.S. Bureau of Labor Statistics (BLS) reports that the median annual salary of chief executives was $185,950 as of May 2020. The BLS notes that the median annual salary of general and operations managers was $103,650.

States Where Entrepreneurs Earn the Most

In addition to the type of business, the amount of work required, and the amount of revenue coming in, an entrepreneur’s salary depends on where the business is located. PayScale reports that a small business owner in Boston earned a salary 90% higher than the median salary as of November 2021, while one in Chicago earned 60% more than the average. By contrast, small business owners in Los Angeles and Seattle earned 60% and 10% lower than the average, respectively.

Zippia lists the 10 states that are best suited to entrepreneurs:

- Oklahoma: $91,000 approximate average salary

- Oregon: $107,000

- Louisiana: $91,000

- Washington: $114,000

- Idaho: $85,000

- Wyoming: $86,000

- New York: $101,000

- Colorado: $96,000

- California: $103,000

- Kansas: $78,000

How Entrepreneurs Choose to Pay Themselves

Most entrepreneurs determine their earnings using one of two approaches:

- The salary method pays on a regular schedule based on either an annual salary or hours worked at a flat rate. Officers of C corporations and owners of S corporations are required to take a salary.

- The owner’s draw method withdraws an amount from the company’s profits and pays that amount to the owner. Profit must account for taxes, rents, employee salaries, equipment, and all other expenses. Draws differ from salaries in that they aren’t subject to withholding for taxes, Social Security, or Medicare when payment is made.

Entrepreneurs must keep business and personal expenses separate, including a distinct bank account. The IRS requires that all employees receive “reasonable” compensation. However, it’s difficult to determine a reasonable salary in the early stages of the business. These are among the factors to consider when calculating a fair entrepreneur salary:

- Living expenses: A minimum reasonable salary would be the amount required for you to meet your personal day-to-day expenses in terms of rent or mortgage, utilities, taxes, and other items.

- Industry estimates for similar businesses: Consider the salary of a person you would hire to do your job. A fair salary will likely fall in that range.

- Tax implications: The amount owed in taxes varies based on the type of organization (sole proprietorship, limited liability corporation, S corporation, etc.) and whether you’re paid a salary or draw. Often, the tax burden can be minimized by investing some funds back into the company.

Other factors that affect how much an entrepreneur makes are compensation paid to employees, cash flow, growth rate, and what the company can afford.

New business models make it easy for people to begin their entrepreneurial career as a side business that they run while holding down a full-time job, as CNBC reports.

- Starting slowly allows you to enhance your current income to prepare for launching the business as a full-time endeavor.

- The side business may qualify for tax deductions on the cost of equipment and supplies used for the operation.

- The part-time business gives you a sense of what kind of career it would lead to.

Resources on Entrepreneur Remuneration

- Business Insider, “An Entrepreneur Who Ditched Her 6-Figure Corporate Job Now Earns Thousands in Passive Income Every Month Thanks to a Few Smart Strategies” — Erika Kullberg explains how she built a YouTube channel and a legal business, among other enterprises.

- The Balance Small Business, “Average Small Business Owner Salary in the U.S.” — The article explains the factors that contribute to determining a business owner’s salary, including benefits, bonuses, and commissions.

- Camino Financial, “How to Calculate Your Salary as a Business Owner” — Various formulas are presented that can be used to determine an appropriate salary for a business owner, including the tax implications of different approaches.

The Many Rewards of Succeeding as an Entrepreneur

Nothing matches the financial, professional, and personal rewards of succeeding as an entrepreneur. Success in starting, growing, and maintaining a business requires the right mix of leadership and management skills combined with creative problem-solving and the ability to communicate your vision. When all the pieces fit together, you can watch your idea become a vibrant enterprise.

Infographic Sources

Guidant Financial, “Women in Business: 2021”